Jean Bovin – Head of BlackRock Investment Institute, together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, and Nicholas Fawcett – Macro Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

- Sticky inflation is leading major central banks to keep policy tight. We prefer emerging market debt as policy loosens and like short-dated bonds for income.

- Developed market short-term bond yields jumped after central banks signaled more rate hikes to come. We see rates staying higher for longer.

- This week’s PMIs will help gauge how much rate hikes have cooled activity. We already see signs that a mild recession has unfolded in the U.S. and euro area

Sticky inflation looks to compel developed market (DM) central banks to crank policy rates higher – and keep policy tight for longer. The Federal Reserve paused last week but pointed to more hikes on the way. The European Central Bank (ECB) raised rates and made clear it wasn’t done. Others hiked after earlier pauses. We prefer emerging market (EM) debt due to looser policy potential, like recent rate cuts in China. We also like income opportunities such as short-dated bonds.

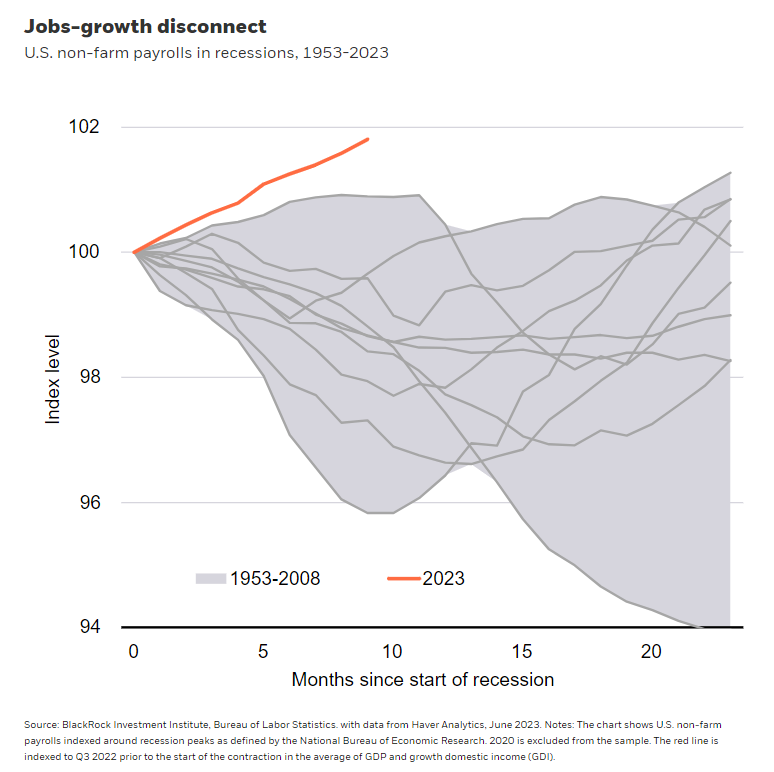

Labor shortages are fueling wage growth, keeping core inflation elevated. That has led the Fed to double down on a “whatever it takes” approach to fighting inflation: Last week it signaled more hikes in the same meeting where it paused. This is happening as central banks in Australia and Canada resumed hikes after attempted pauses – and as the ECB hiked again. We think the Fed and ECB appear to be underappreciating the existing damage from hikes. The Fed revised its growth forecast up based on historically low unemployment. The Fed may be relying on a job and growth relationship that has broken, in our view. Labor shortages have made firms reluctant to let workers go, even as demand slows and growth stagnates. That has made job growth look resilient (orange line in the chart) in recent months compared with weaker jobs data in past recessions (gray lines), even as some data suggest recession may have already arrived.

A broad measure of activity that in the past has been a good indicator suggests as much. The average of U.S. gross domestic income and GDP has contracted for two consecutive quarters. We think the Fed’s improved growth forecast ignores the sharp trade-off it faces: crush growth or live with inflation. We think it also exposes an important inconsistency: even higher rates to combat still-high inflation – but with a better growth outlook than previously expected. We don’t think the Fed can expect to bring inflation back down so quickly and maintain such an optimistic view on growth. CPI data last week confirmed core inflation is not cooling enough yet for inflation to return to 2%. We prefer short-term government bonds for income as interest rates stay higher for longer.

Pricing policy

This new regime of heightened macro and market volatility requires us to constantly assess what is being priced by markets. That helps uncover regional nuance in how markets are interpreting the macro story across DM. The ECB’s determination to keep hiking has pushed up euro area government bond yields. The market pricing of hikes by the ECB and the Bank of England have become more extreme than our view: Pricing shows rates for both staying higher for much longer than the Fed while inflation stays elevated. Recent wage data in the UK confirmed the worker shortage and supply constraints plaguing other DMs, but we don’t see the inflation problems there or in the euro area as fundamentally much worse than in the U.S. The market pricing in more rate hikes than we think likely is what led us to close our previous underweight on UK gilts in May. We find gilt yields more attractive after having risen near levels reached during 2022’s budget turmoil and prefer short-term maturities. We also like global inflation-linked bonds due to persistently higher inflation.

Emerging market contrast

The EM policy picture stands in sharp contrast with DM. EM central banks started hiking sooner and we think their hiking cycles are closer to an end. That’s why we like EM local currency debt, especially in Brazil and Mexico. Falling inflation makes room for central banks in the emerging world to loosen monetary policy, we think. Case in point: China cut some policy rates just last week as its economic restart from pandemic lockdowns loses steam. Brazil’s central bank governor also hinted last week that the central bank could start cutting rates soon. The market has priced in cuts starting in August through year-end.

Bottom line

We think tight policy is likely here to stay as sticky inflation compels major central banks to keep policy tight – and likely tighten even further. We see more scope for policy easing in EM – that’s why we prefer EM local currency debt. We also like short-dated bonds for income against this backdrop. Read more in our 2023 midyear outlook on June 28.

Market backdrop

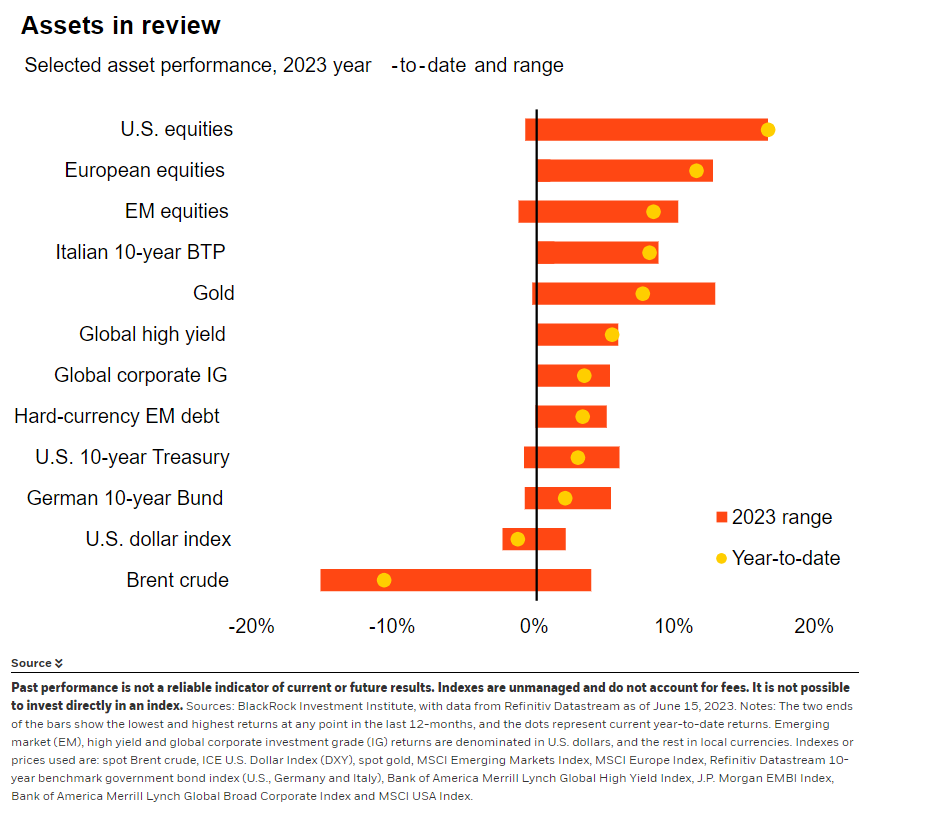

Short-term bond yields jumped in the euro area and UK on market expectations for further rate hikes after the ECB’s signal and UK data showed surprisingly strong wages. Two-year Treasury yields also rose as the Fed signaled more rate hikes even after a pause. These events confirm the ongoing tightening bias of central banks facing sticky inflation. DM stocks hit new 14-month highs, with gains broadening beyond the mega cap tech shares that have been the big winners this year.

Global manufacturing and services data will be in focus this week to gauge how much rate hikes have cooled activity. The U.S. has entered a mild recession based on an income measure. So has the euro area, after two consecutive quarters of contracting growth. We think central banks will keep rates higher for longer to fight stubborn inflation even as activity slows.

Week Ahead

June 20: U.S. housing starts

June 21: UK CPI

June 22: U.S. existing home sales; Bank of England policy decision

June 23: Japan CPI; global flash PMIs

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 12th June, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.