Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute together with Ben Powell – Chief Investment Strategist for APAC, Tony Kim – Head of Global Technology Team, Fundamental Equities, and Andreea Mitrache – Portfolio Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

AI revolution: We see artificial intelligence (AI) as a mega force shaping the new regime. We are overweight the AI theme in developed market stocks.

Market backdrop: U.S. stocks and 10-year Treasury yields both rose last week. We see investors demanding more compensation for the risk of holding long-term bonds.

Week ahead: U.S. CPI data is in focus this week. The presidents of the U.S. and China will meet for a summit at a time of heightened strategic competition and tensions.

The buzz about AI is getting louder, with tech shares maintaining their outperformance and major players getting ready to roll out new AI tools. We see AI as one of five mega forces, or structural shifts that can drive returns now and in the future. We are overweight the AI theme in developed market (DM) stocks. We see the implications of AI going beyond pure technology companies, transcending sectors and geographies. See our new publication, AI – beyond the buzz, for details.

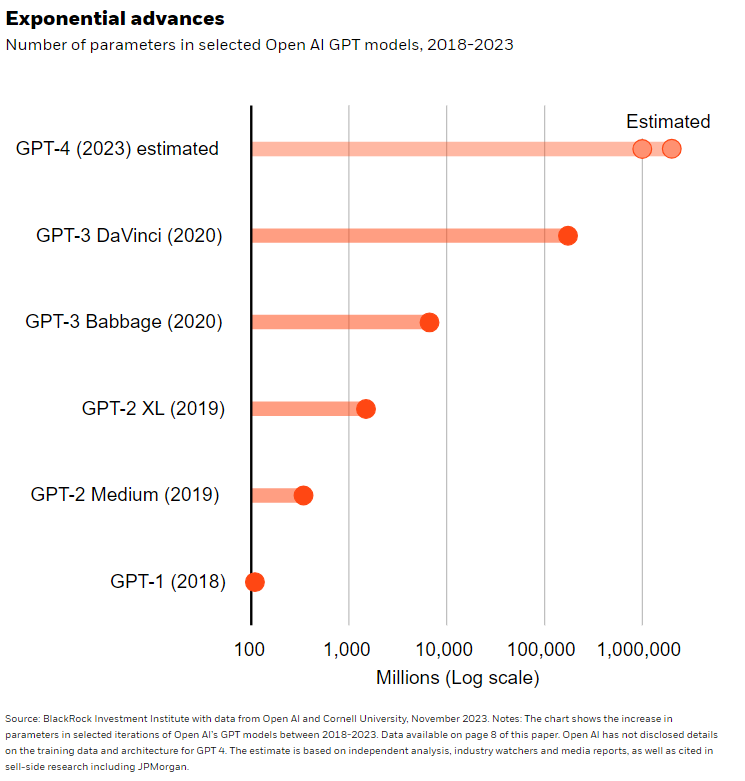

Advances in computing hardware and deep learning innovations led to an inflection point for AI in late 2022. We think we are at the dawn of an intelligence revolution – with exponential advances. For example, the number of “parameters” between OpenAI’s ChatGPT-1 and GPT-4 models has likely surged exponentially in five years. See the chart. Parameters are elements of a model learned from historical data that allow it to generate text or multimedia content based on a prompt. The higher the number of parameters, the more sophisticated a model’s understanding of patterns and the more nuanced its output. We expect exponential growth to persist. The tech sector is largely benefiting so far: Mega cap tech names account for most S&P 500 returns this year, yet when stripping out their impact broader stocks are down, LSEG data show. Mega cap tech stocks have outperformed by delivering on earnings, even with the yield jump that can hurt long-term valuations.

We observe a fundamental shift in the tech industry towards AI-centric business models, igniting a competitive race among a handful of mega cap companies. We view this evolution in terms of a technology “stack,” with increasingly foundational technologies appearing closer to the bottom. The first layer covers cloud infrastructure and chipmakers – the building blocks of computing power that have already begun to reap the benefits of AI advancements. The second layer covers models, data and data infrastructure. This layer may be underappreciated as demand for digital infrastructure like hardware, data and server farm locations is likely to outstrip supply. At the pinnacle of the stack are the applications that leverage these innovations. We think we are currently somewhere between the first and second layers, with the top layer likely coming next.

Far-reaching impact

AI-powered automation has the potential to boost worker productivity, and may offer a competitive advantage to companies, sectors and economies that more adeptly adopt this technology. The implications may impact economies and markets faster than generally expected. AI’s impact is set to span multiple domains, in our view, intersecting with mega forces like aging populations and geopolitical competition. Companies will likely succeed by attracting top talent and being able to invest in scaling up computational power to harness their data. The flood of AI patents may help identify some pioneers and laggards. Our research suggests there is a positive correlation between an uptick in AI patents and earnings growth in the one-to-two years after the patent registration. Our work also finds that private companies primarily produce AI patents, making private markets another way to tap into the AI theme. While not every patent leads to commercial success, the rising market value of AI patents indicates investor enthusiasm for the potential outsized returns for companies who are working to incorporate AI.

Like any technology, AI has adoption limits. Cybersecurity risks abound yet may spawn opportunities for consultancies or start-ups that specialize in setting up secure AI environments for other firms. Generative AI, which learns from massive data sets to create new content, still faces reliability issues. The tech can be prone to “hallucinations,” generating outputs that aren’t grounded in the input data. We think future versions will likely gradually improve. Global governments are trying to address the risks – potentially slowing adoption in some sectors – and shape AI business conduct, spurring opportunities.

Bottom line

AI’s interaction with other technologies and mega forces is likely to yield the biggest investment opportunities, in our view. We see a multi-country and multi-sector AI-centered investment cycle unfolding that we think will support revenues and margins. We’re overweight the AI theme in DM stocks on a six-to-12-month horizon as we see it set to keep unfolding.

Market backdrop

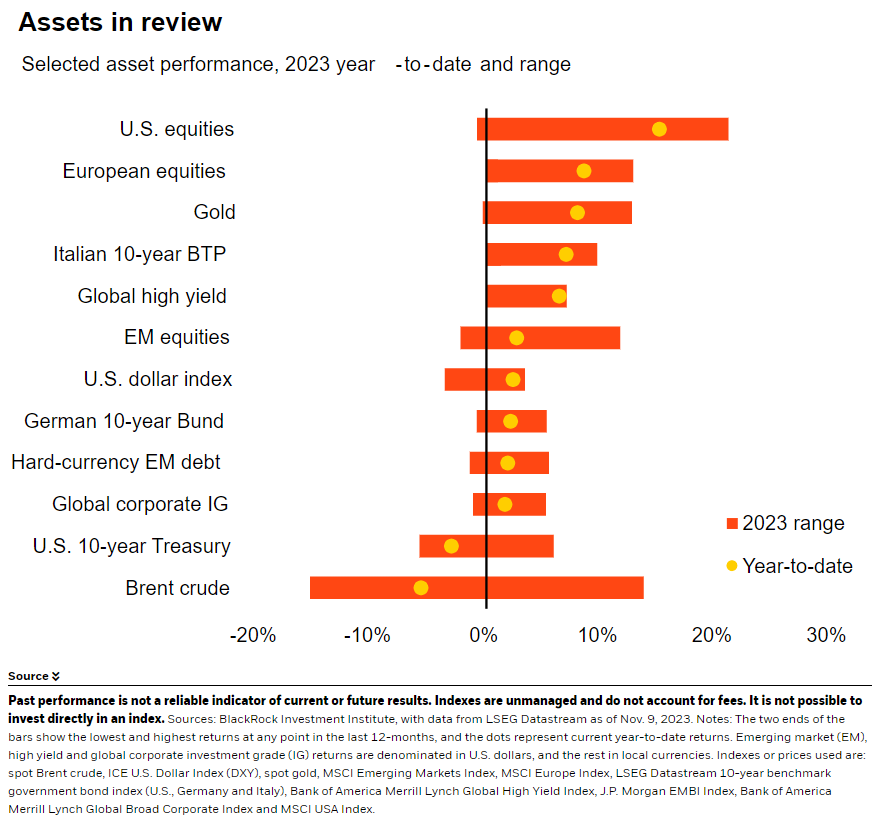

U.S. stocks gained and are up 7% from their October lows. U.S. 10-year yields edged up but are still below their 16-year highs hit last month. We think the yield volatility is one reason why investors are starting to demand more compensation for the risk of holding long-term bonds. U.S. Q3 corporate earnings results have showed a handful of mega cap stocks are still propping up earnings – and analysts are downgrading expected earnings due to the cautious tone from companies.

We’re watching U.S. inflation data this week to see how much inflation falls as pandemic-driven economic mismatches keep unwinding. Yet we think tight labor markets and a shrinking workforce will keep inflation on a rollercoaster. U.S.-China tensions will be in focus with Presidents Joe Biden and Xi Jinping set to meet at a summit in San Francisco.

Week Ahead

Nov. 14: U.S. CPI; euro area and Japan GDP

Nov. 15: Presidents Biden, Xi meet; UK CPI; Japan trade;

Nov. 17: Euro area inflation

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 13th November, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.