Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Vivek Paul – Global Head of Portfolio, and Ben Powell – Chief Investment Strategist for the Middle East and APAC all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Forum takeaways: Market-moving events can highlight structural shifts underway. Our investment leaders grapple with the implications of a world shaped by supply.

Market backdrop: U.S. stocks soared last week, marking their largest weekly gain of the year. Small caps and banks led the way following President-elect Donald Trump’s victory.

Week ahead: This week, U.S. CPI will help gauge if inflation is still falling toward the Fed’s 2% target. Recent PCE data indicates inflation will settle higher in the medium term.

We are in a world where multiple, starkly different outcomes are possible. The decisive U.S. election outcome has stoked uncertainty about future U.S. policy. At our 2025 Outlook Forum last week, BlackRock investment leaders met to discuss how to invest given large structural shifts happening now – and we updated the range of scenarios we considered feasible six months ago, reflecting our discussions on U.S. exceptionalism, geopolitics and artificial intelligence (AI).

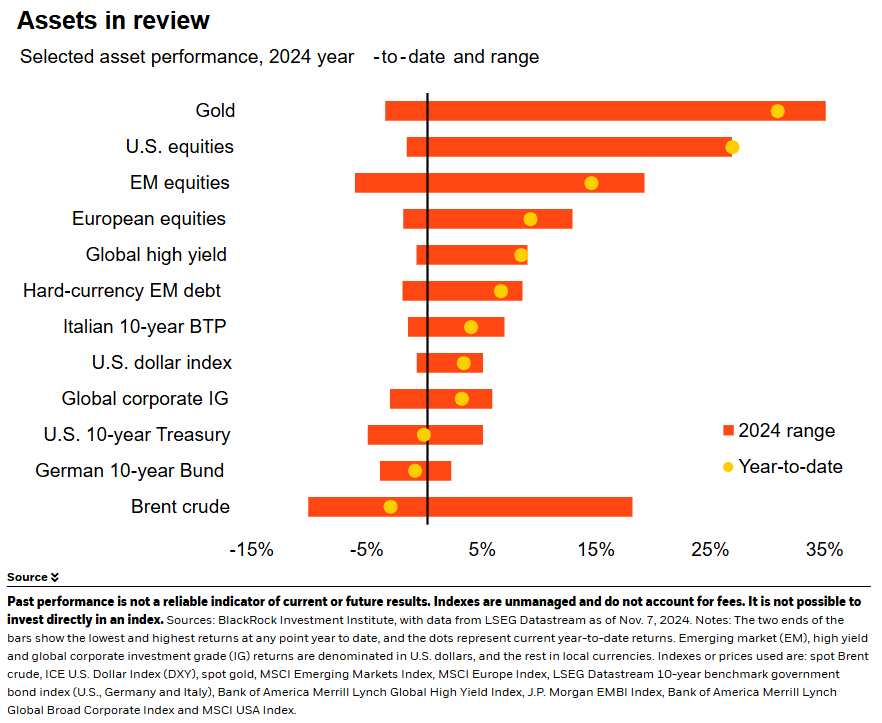

Our Outlook Forum took place against the backdrop of a momentous U.S. election. Markets welcomed the decisive result that took some near-term uncertainty off the table – even as medium-term policy uncertainty remains. Shifting narratives, from AI booms to recession fears, have driven volatility this year. Markets can overreact to these shifts. We have seen unusually sharp swings in 10-year U.S. Treasury yields with key macro releases. See the chart. We think that reflects investors viewing new data and news through a business cycle lens when broader structural changes are at play. We have been nimble with our tactical view changes this year to lean against narrative-driven volatility. The goal of last week’s Forum: tracking the transformation driven by these structural changes. We evolved our macro scenarios to better understand and position for the transformation’s opportunities.

Structural forces at play

U.S. exceptionalism – strong economic and corporate earnings growth – was a topic of debate at the Forum. Our portfolio managers are broadly positive on U.S. equity markets. They noted this has more room to run, even if U.S. stock valuations look steep. The contrast with lagging European economic growth, and stock performance, remains stark. Forum participants also spied a disconnect in Fed policy. The Fed cut its policy rate another 25 basis points last week as it sees inflation moving closer to its 2% target. Yet financial conditions are loose after a historically sharp tightening cycle. This unusual backdrop reinforces our view that this is not a typical business cycle – but rather an environment where structural forces are at play.

The geopolitical fragmentation mega force – or structural shift impacting returns now and in the future – ran through most discussions. The incoming U.S. president takes office at a time of greater global fragility given wars in the Middle East and Ukraine, and ongoing tensions with China. A punishing year for incumbents around the globe is pressuring G7 partners. Germany is headed for a new election. This follows France’s divided election outcome earlier this year. The reform proposals laid out by Mario Draghi detail the challenges Europe faces. China rolled out some details of its fiscal stimulus highlighting its weak growth near term – and also faces long-term challenges from an aging population. AI will increasingly take center stage in geopolitics, featuring heavily in U.S.-China strategic tech competition. Under the Biden administration, the U.S. has elevated AI to the core of its military and technological priorities.

The debate on the impact of the AI mega force keeps evolving. Much of the discussion at our last Forum in June centered on AI and its energy and investment needs. That was still a focus – and we generally agreed that the AI buildout can broaden to include other beneficiaries. Quantifying AI’s longer-term economic impact remains challenging, but we think AI has the potential to eventually reshape economies and boost economic growth.

Our bottom line

Our Forum discussion sought to clarify how structural shifts are driving the investment opportunities we see while assessing what’s in the price. We think having a solid framework is key for anchoring views in this unusual environment.

Market backdrop

U.S. stocks soared to new all-time highs last week, notching their largest weekly gain of the year. Small caps and banks led the way as possible beneficiaries of a second Trump term. U.S. 10-year Treasury yields finished around 4.30%, down slightly on the week after jumping to four-month highs. A telegraphed 25-basis point Fed rate cut failed to move markets. Pricing of future cuts has come closer to our view, yet we still see rates settling higher than markets do.

This week, we focus on U.S. CPI to see if inflation will keep falling toward the Fed’s 2% target. Short-term inflation has been decreasing, with immigration boosting the labor supply and cooling wage growth. However, recent services PCE data remains sticky, indicating that inflation may settle above 2% in the medium term. Long-term, structural supply constraints – like a shrinking workforce due to population aging – are expected to keep inflation pressures persistent.

Week Ahead

Nov. 12: UK employment data

Nov. 13: U.S. core CPI

Nov. 15: UK GDP; Japan GDP

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 11th November, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.