Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Raffaele Savi – Global Head of Systematic, and Nicholas Fawcett – Senior Economist all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Our AI view: We believe AI could radically reshape economies and markets. Identifying the full slate of potential beneficiaries calls for an active investment approach.

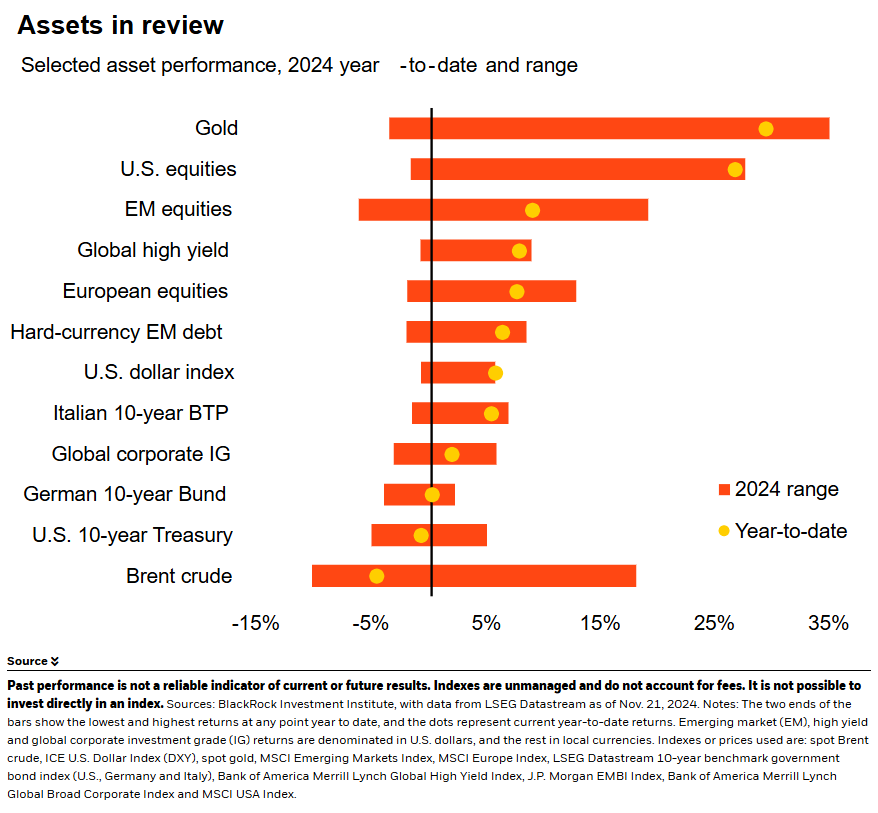

Market backdrop: U.S. stocks edged up near record highs last week, with shares of Nvidia rising on Q3 corporate earnings. U.S. 10-year Treasury yields stuck near six-month highs.

Week ahead: We eye October U.S. core PCE. Recent wage data shows gains stay elevated and suggests core inflation is unlikely to cool near the Federal Reserve’s 2% target.

Nvidia’s Q3 corporate earnings results show the buildout of artificial intelligence (AI) data centers is powering ahead as tech firms race to build the infrastructure AI needs. We think AI could eventually radically reshape economies and markets. Yet uncertainty over how AI evolves from here raises big questions. We use our three-phase framework – buildout, adoption, transformation – to track the AI revolution. Taking an active approach helps us identify and capture investment opportunities.

In the buildout phase underway, tech giants are pouring record amounts of capital into AI. Chips are the single largest cost and Nvidia is one of the big winners of that demand. Some of the most powerful chips can cost $40 billion per gigawatt versus $10-20 billion for traditional chips, according to Thunder Said Energy. Advanced chips are one reason AI data centers – the backbone of the buildout – are costlier than traditional ones. See the chart. Spending on traditional and AI data centers combined could top U.S. $700 billion annually by 2030, industry estimates show. All this spending could add to inflation, including via higher near-term energy costs given AI’s huge power needs. Eventually, AI could boost energy efficiency, offsetting some of the initial spike in energy demand. Yet those savings can come only after mass AI adoption, a process that will take time.

We think investment in AI could rival the amount seen in the industrial revolution – especially once including the spending on energy infrastructure as part of both the data center buildout and the low-carbon transition. Investment of this magnitude demands significant financing, creating a key funding role for capital markets and private markets. Yet private markets are complex and not suitable for all investors. We see big cloud providers and chip producers as the buildout’s main beneficiaries – particularly mega cap tech companies, whose unmatched resources and tech expertise give them a competitive advantage.

AI’s impact on the grid

Questions around AI overinvestment are valid. Yet we think this should be assessed in aggregate, given AI’s potential to unlock new revenue streams across the whole economy. Mega cap tech does not look overextended for now. Comparisons to the dot-com era fall short, according to BlackRock’s Systematic Active Equity team: Analysis of hundreds of metrics on valuations, earnings and other features reveals few similarities between now and then. Beyond tech, other likely beneficiaries of the buildout include companies in the utilities, energy, industrials, materials and real estate sectors providing key inputs.

What comes after the buildout raises more big questions. Part of AI’s promise hinges on its ability to drive a productivity boom. Near term, we expect moderate productivity gains as AI reshapes specific tasks. Longer term, AI could accelerate the process of generating new ideas and discoveries, with far-reaching implications for innovation and growth. Much depends on how rapidly AI is adopted across industries. Broad adoption could alter the makeup of the economy by shifting labor and resources, creating new jobs and industries. Sectors like finance and IT could benefit as early adopters. If adoption happens too quickly, it could drive inflation as demand grows faster than resources can be reallocated and workers reskilled. Yet it is difficult now to imagine all of the future AI use cases. Navigating this uncertainty calls for an active investment approach, in our view. Private markets can provide an opportunity to invest in potential winners before they are publicly listed.

Our bottom line

Investment opportunities in the AI buildout expand beyond tech into sectors providing key energy, infrastructure and data center inputs. Uncertainty beyond the buildout calls for an active approach to identify future beneficiaries.

Market backdrop

U.S. stocks edged up last week, hovering just off record highs. Nvidia’s strong Q3 corporate earnings results show robust demand for its chips, a sign the AI buildout is powering ahead. Flash PMIs for November offered a glimpse into uneven global growth: The U.S. composite PMI showed growth accelerating further, while the euro area PMI showed activity shrinking and hit 10-month lows. U.S. 10-year Treasury yields were flat at 4.41%, sticking near their six-month peak.

This week, we get October U.S. core PCE, the Federal Reserve’s preferred inflation measure. We eye core services inflation for clues on where core inflation ultimately settles. Recent wage data shows gains remain elevated and suggests core inflation is unlikely to cool near the Fed’s 2% target. Markets have been pricing out Fed rate cuts — and moving closer to our view — as it becomes clearer that inflation pressures could prove persistent.

Week Ahead

Nov. 26: U.S. consumer confidence survey

Nov. 27: U.S. core PCE; U.S. durable goods

Nov. 29: Euro area inflation data; Japan unemployment data

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 25th November, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.