|me> borrow

Creating a future together

Are you buying your first property? Would you like to purchase a rental investment? We have got you covered.

We pride ourselves on making your home loan experience as easy as possible, with great interest rates, no processing fees and much more.

Every reason to borrow

Speedy response times

Interest only option

Buying a new home is exciting but also demanding. We are here to make life easier by offering the possibility to pay interest only during the initial 18 months of your loan.

Customer centric service

Seamless Process

Our Mortgage Products

Home Loans

If you are looking to buy your primary or secondary residential property or want to refinance your existing home loan facility, we will quickly assess your eligibility for a Home Loan.

Green Home Loans

You can reduce your energy consumption and help contribute towards a greener world. To reward this efficiency, we will give you preferential rates on your Green Home Loan.

Home Equity Loans

Home equity is the difference between the value of your property and any existing home loans. You can unlock that value through a Home Equity Loan to purchase the car of your dreams or buy a boat, amongst other things.

Property Investment Loans

Borrow

Your

Way!

Frequently Asked Questions

How will I know if I am eligible for a MeDirect Home Loan?

At MeDirect we promise speedy response times on our home loans. If you are looking to buy your primary or secondary residential property or want to refinance your existing home loan facility, we will quickly assess your eligibility for a home loan. You need to be over 18 years of age, have an income and enough savings to cover at least 10% of the property cost for your primary residence. If you are purchasing a secondary residence, you will need to have saved at least 25% of the property cost. Our team is on hand to help you finance all the costs in relation to the acquisition, construction and finishing of your property.

How much is the maximum amount I can borrow?

When assessing your borrowing capacity, we will look at your overall financial situation. This mainly includes:

- Your current income

- Your financial commitments

Our Eligibility Calculator will help you get a better understanding of the maximum amount you will be able to borrow.

How much would my initial deposit need to be?

This will be defind depending on which type of residence you are looking to purchase.

| Maximum Loan Amount of the Total Project Cost | Initial Contribution of the Total Project Cost | |

| Acquisition of Primary Residence | Up to 90%* | 10% |

| Acquisition of Second Property | Up to 75%* | 25% |

* Terms & Conditions apply.

More FAQs

Applications are subject to the Bank’s lending criteria. Terms and conditions apply and are available on request.

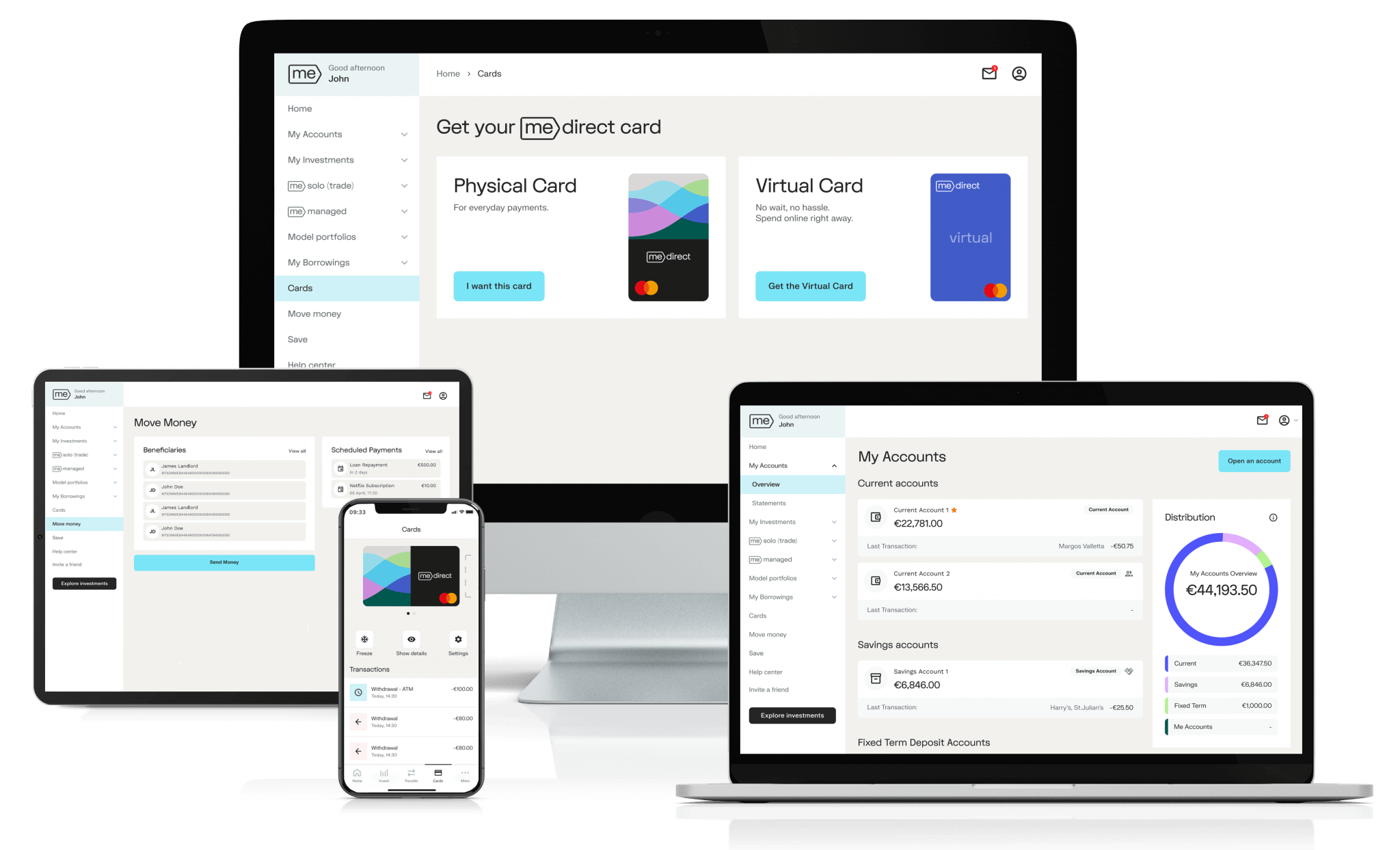

Experience better Banking

The sooner you start managing your money, your way, using the best-in-class tools, the sooner you’ll see results.

Sign up and open your account for free, within minutes.