Wei Li – Global Chief Investment Strategist, together with Christopher Kaminker – Head of Sustainable Research and Analytics, Alex Brazier – Deputy Head, Nicholas Fawcett – Macro research, and Chris Weber – Head of Climate Research, all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Clean energy race: We see the U.S. policy push for leadership in clean tech and Europe’s fast-developing response creating near-term and strategic investment opportunities.

Market backdrop: Risk assets rallied amid stabilizing sentiment toward banks. Yet the disconnect between sticky inflation and market expectations of rate cuts persists.

Week ahead: This week, we’re watching U.S. employment data to gauge how tight the labor market remains. We see wage pressures contributing to persistent inflation.

U.S. industrial policy has sparked a global clean energy race, we believe, opening up investment opportunities that so far have gone largely under the radar. It’s key not to lose sight of such profound policy developments amid market volatility. The U.S. already has strong incentives for domestic clean-tech production. The European Union (EU) now aims to speed up deployment of funds and to build out clean tech at home, driven by a search for energy security and competitiveness.

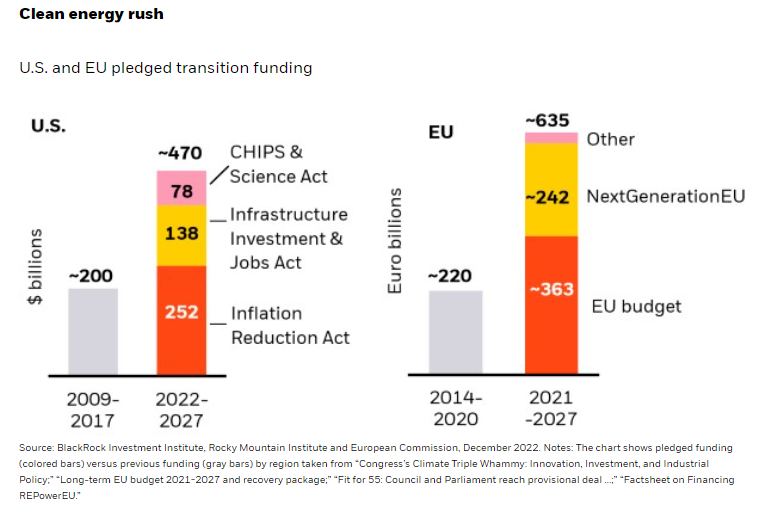

The U.S. Inflation Reduction Act of August 2022 unleashed a slew of production incentives in areas tied to the transition to lower carbon emissions. The EU already had robust transition policy. An expanded carbon pricing program encourages EU firms to expedite transition plans, with the price of carbon recently passing €100 per tonne. The EU also had put even more public investment in aggregate on the table (see the chart). But an estimated $400 billion of that is still unspent, and the EU had less focus on encouraging domestic production of low-carbon technology. The EU responded to the U.S. this year with its Green Deal Industrial Plan (GDIP). This aims to boost European manufacturing of key transition technologies via domestic production targets, provide easier access to funding and fast-track permitting. The resulting growth in these areas is not always fully reflected in markets, in our view, creating global investment opportunities.

The U.S. and European policy initiatives are about getting a slice of the growing clean-tech pie and reducing reliance on China for minerals and metals needed for the transition, in our view. We see this as the start of a clean energy race as countries rush to adopt similar policies – a strategic priority against a backdrop of growing geopolitical fragmentation. The UK, Canada and Australia are all set to jump in, and this race fits with our view that the transition is likely to accelerate.

EU plan

The EU has most at stake to ensure energy security as the West shuns Russian oil and gas, we think, and U.S. policy has shifted focus to domestic production. The EU has extended until the end of 2025 the temporary state aid rules introduced in response to the pandemic, renaming them the Temporary Crisis and Transition Framework. If implemented, this will make it easier for member states to offer similarly generous subsidies to prevent an exodus of clean-tech firms and capital to the U.S. The EU’s plan could unleash more extensive public funding for European clean-tech production. But questions remain: Will member states agree to step up spending within the new rules? Can they afford to given the estimated $350 billion already spent on energy bill support for consumers last year? Can they cut more red tape? And will the EU’s energy windfall taxes deter businesses and investors anyway?

Investment implications

The investment implications of these new policies depend on earnings impact and what’s already reflected in market prices. We think the potential growth implications for selected transition-linked assets are not fully reflected – creating opportunities to add to returns. U.S. stocks seen as benefitting from recent transition policy jumped ahead of EU peers after the Inflation Reduction Act passed – the latter still show little impact from the GDIP, our analysis shows. Sustained growth of global energy demand and the West’s shunning of Russian supplies mean we see ongoing demand for traditional energy – even with rapid growth of clean-energy production. Both traditional energy and renewable energy stocks outperformed their benchmarks last year, we find. Portfolios that exclude traditional energy are unlikely to be as resilient to the expected bumps in the transition to a lower-carbon economy, in our view. We think the new regime of more persistent and volatile inflation is likely to manifest in the transition as mismatches of supply struggling to meet rapidly increasing demand and investment.

Our bottom line

We see opportunities within transition-linked assets and stay nimble and selective for global diversification as a clean energy race heats up. We favor inflation-linked bonds on the potential for supply and demand imbalances in the transition and see real assets like infrastructure providing long-term hedging against inflation.

Market backdrop

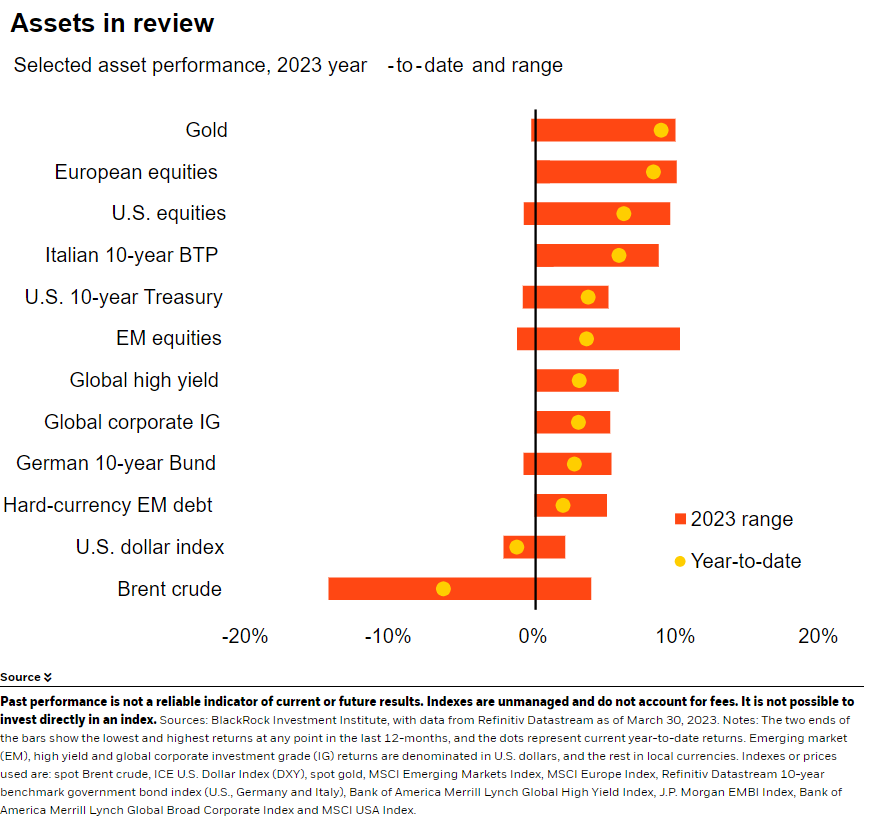

Risk assets rallied this week amid stabilizing sentiment on banks to close a tumultuous quarter. Yet the disconnect between sticky inflation and market expectations of rate cuts persists. The Nasdaq – up nearly 20% in the first quarter of 2023 – had its best quarter in nearly three years. The two-year U.S. Treasury yield has steadied around 4.0% – about 1 percentage point below the 16-year high from early March with markets still eyeing two quarter-point Federal Reserve rate cuts this year.

This week U.S. payrolls will help indicate how tight the labor market remains and how resilient companies have been to the rapid rate hiking cycle. We see wage pressures contributing to persistent inflation. We’re also watching PMI data in the U.S. to gauge if tightening policy is causing manufacturing activity to contract further and if service strength is waning.

Week Ahead

April 3: U.S. ISM manufacturing PMI

April 5: U.S. ISM services PMI

April 6: China Caixin services PMI

April 7: U.S. payrolls and unemployment

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 3rd April, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.