Jean Bovin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Alex Brazier – Deputy Head, Fundamental Equities, and Vivek Paul – Global Head of Portfolio Research all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Volatile new regime: We see volatility as a constant in the new regime. We’re neutral long-term U.S. Treasuries because risks are more balanced after three years of rising yields.

Market backdrop: Stocks and bonds rallied last week on milder-than-expected U.S. inflation data. We see the U.S. economy on a weak growth path, with policy rates staying high.

Week ahead: Global PMI data this week will likely confirm that higher interest rates are causing business activity to stagnate. We don’t expect rate cuts this year.

The plunge in long-term U.S. Treasury yields last week on news of slowing U.S. inflation shows volatility is persistent in the new regime of greater macro uncertainty. Compounding this is a disconnect between the latest cyclical market narrative of a strong expansion – and the reality we have just climbed out of a deep economic hole caused by the pandemic. This disconnect risks obscuring the new regime’s opportunities – a key conclusion of our 2024 Outlook Forum last week.

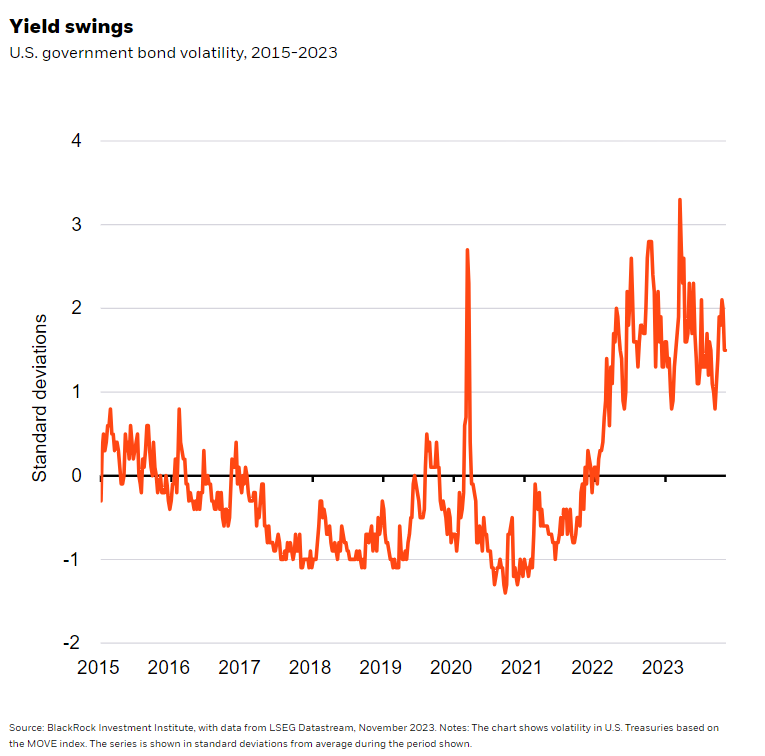

Stocks rallied, and yields on 10-year U.S. Treasuries tumbled 19 basis points last week – the biggest one-day move since the March U.S. banking turmoil. The drop came after news of a slower-than-expected pace of inflation. This is keeping bond volatility at much higher levels than before the pandemic, as the chart shows. The current market narrative: Inflation is falling while growth is holding up. We agree with the first part – for now. We see core inflation hitting the Fed’s 2% target in the second half of 2024. The problem: Inflation is falling because rapid rate rises to combat it have pushed U.S. growth trend below pre-Covid levels. We think more of the same is needed to keep inflation down as price pressures resume amid slowing labor force growth and geopolitical shocks. Markets appear to miss this bigger picture, and we see more volatility ahead as they swing between hopes for a “soft landing” and fears about higher rates and recession.

We upgraded long-term Treasuries to neutral on a tactical, six-to-12-month horizon last month because we now see even odds of yields swinging in either direction in this volatile environment. That’s in part because the Fed seems to be at the end of its rate hike cycle. Yet looser fiscal policy and slowing labor force growth will likely force the Fed to keep rates high for longer. Long-term yields should eventually resume their march higher. Why? We expect the term premium, or the compensation investors demand for the risk of holding long-term bonds, to keep rising amid greater macro volatility, large fiscal deficits and high debt issuance.

Looking ahead

Indeed, U.S. fiscal challenges have already contributed to volatility, and we see that playing out further. The U.S. government ramped up spending to restart the economy from pandemic lockdowns and launched other stimulus such as the Inflation Reduction Act. Bond issuance ballooned as a result. Higher interest rates are feeding into this cycle by raising government borrowing costs and adding to the debt burden. If borrowing costs stay near 5% as we expect, the U.S. government is poised to spend more on interest payments than on Medicare in a few years time. Investors are struggling to absorb the bond supply. Their indigestion spurred another surge in bond yields earlier this month after an auction for 30-year Treasuries saw historically weak demand.

Higher rates and volatility took center stage at our semi-annual Investment Outlook Forum held last week in New York. Some 100 BlackRock portfolio managers, executives and experts spent two days pinpointing investment opportunities and risks. Adapting portfolios to higher interest rates and mega forces – structural shifts such as geopolitical fragmentation and demographic divergence – were top of mind. Participants debated how to go beyond the obvious beneficiaries of mega forces, and highlighted granular opportunities within sectors and countries such as Japan. There was consensus that the new regime calls for selective and dynamic investment strategies, rather than static and broad exposures. And many saw wider dispersion of security returns – a feature of the new regime – and greater volatility opening opportunities to generate above-benchmark returns. Look for the details in our 2024 Global Outlook slated to come out in early December.

Bottom line

Volatility is a constant in the new regime, with markets quick to extrapolate single data releases. We believe the Fed is ending its hiking cycle – and is set to keep rates high for longer. This underpins why we have turned neutral long-term Treasuries and are overweight short-term Treasuries and European government bonds for income.

Market backdrop

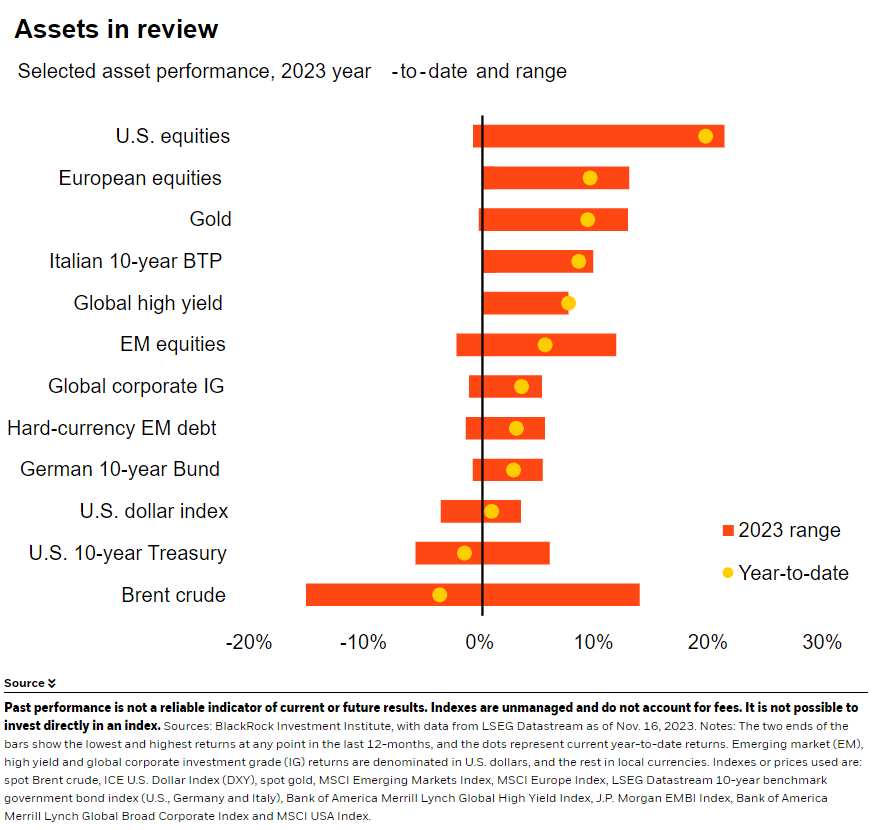

U.S. stocks jumped about 2% last week, and 10-year U.S. Treasury yields slid sharply after the U.S. CPI data showed inflation slowing more than expected. Long-term U.S. yields have swung sharply – a reflection of the volatile new regime – after reaching 16-year highs last month as markets hope for sharp Fed rate cuts next year. We don’t think that is likely and see the Fed only starting to trim rates in the second half of 2024.

Global manufacturing and services PMI data out this week will likely confirm that higher interest rates are causing global production and business activity to stagnate. We think most developed market central banks will keep policy rates high for longer to lean against inflationary pressures – even as activity slows.

Week Ahead

Nov. 23: Euro area, UK flash PMI

Nov. 24: U.S. flash PMI; Japan flash PMI, CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 20th November, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.