Jean Boivin Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Nicholas Fawcett – Macro Research and Tara Iyer – Chief U.S. Macro Strategist all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Different macro outlooks: Markets see a positive near-term macro and corporate backdrop for the U.S. and Japan. We eye risks ahead but remain overweight stocks in both countries.

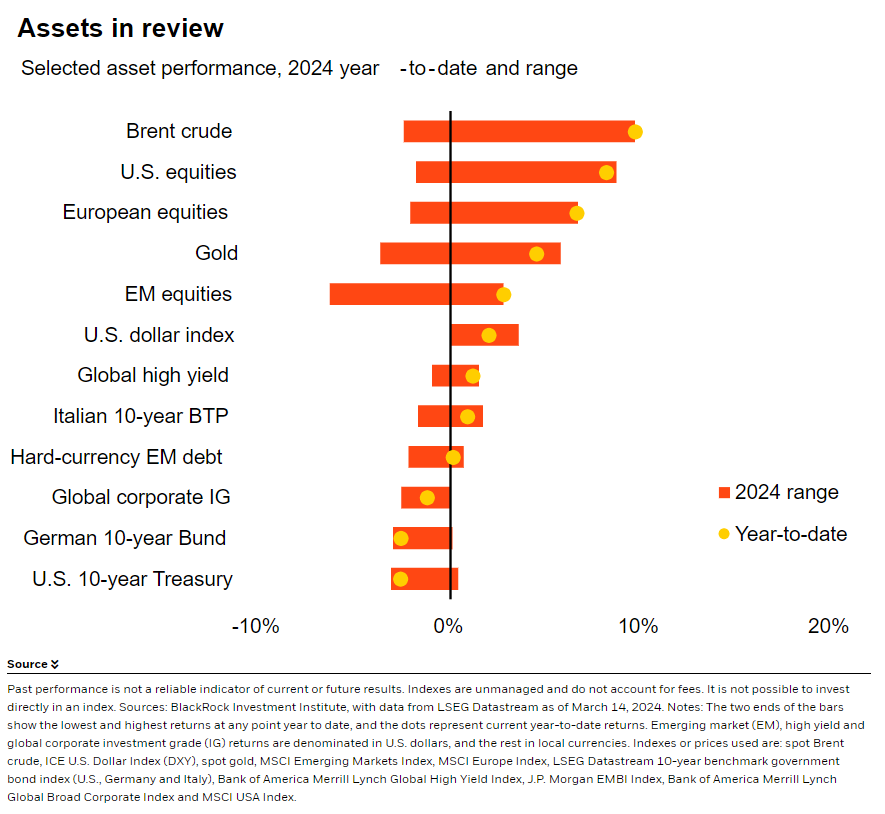

Market backdrop: U.S. stocks were largely flat last week after hotter-than-expected inflation data. Both 10-year U.S. Treasury and Japanese government bond yields rose.

Week ahead: The Fed policy decision is in focus this week. We see Fed rates staying higher for longer than pre-pandemic. We watch how the Bank of Japan interprets inflation.

Federal Reserve and Bank of Japan (BOJ) meetings this week and recent data put a spotlight on the U.S. and Japanese macro environments. U.S. markets are pricing in a positive macro backdrop as inflation cools. We don’t see upbeat risk appetite being seriously challenged in coming months. By contrast, Japan’s macro and corporate outlook is positive longer term. We see the BOJ simply ending negative interest rates, not starting to tighten. We stay overweight U.S. and Japan stocks.

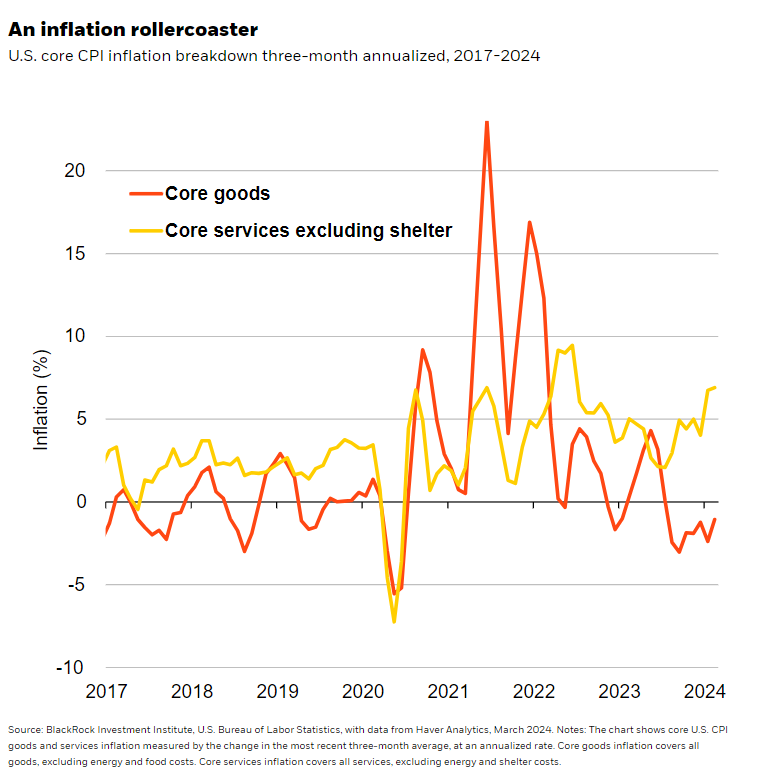

We’ve said before that this new macro and market regime is marked by persistent, structural inflation pressures. We think U.S. inflation can fall further toward 2% this year due to falling goods prices. See the orange line in the chart. Yet we see it on a rollercoaster back up in 2025 as the drag from goods deflation fades and elevated wage growth in a tight labor market keeps services inflation higher than pre-pandemic. Inflation is likely to settle above the Fed’s 2% target in 2025. The spike in services inflation for January (yellow line) now looks like a one-off, but we think it keeps inflation on an elevated track that is inconsistent with overall inflation at 2%. And after months of falling good prices driving inflation lower, they suddenly rose in February. We see more goods deflation to come in the near term. Yet these one-offs may be offering a glimpse of the trickier inflation environment ahead later this year.

Markets are, for now, comfortable that inflation will cool enough to allow the Fed to make three quarter-point rate cuts this year and keep cutting. We think upbeat sentiment can persist as inflation keeps falling. That’s why we stay overweight U.S. stocks and lean into the artificial intelligence theme as tech drives corporate earnings growth. The earnings recovery in other sectors is supporting risk appetite. Yet inflation could come in stronger than markets expect again and challenge risk-taking. That outcome would limit how far and how fast the Fed can cut rates from restrictive levels. We see Fed policy rates staying higher than before the pandemic as inflation likely settles closer to 3%. We believe that calls for staying nimble in portfolios.

The macro outlook for Japan

Meanwhile, the BOJ is focused on keeping inflation sustainably at 2% after decades of ultra-low inflation. Its challenge: gauging how to normalize monetary policy without undermining its hard-won revival of expectations for sustained inflation, in our view. Rising import prices have helped Japan’s inflation rise above 2%. Yet keeping inflation there will require such expectations to feed through domestic prices and wages. The good news: Annual union wage negotiations resulted in pay gains topping 5%, the largest since the early 1990s. That should boost the BOJ’s conviction of overcoming a decades-long undershoot of its inflation target. Markets are pricing that the BOJ could end negative interest rates as soon as this week. If markets see the policy shift as normalizing policy, we think that would support risk appetite. Yet if this policy change is viewed as the BOJ getting nervous about inflation, that could spell bad news for sentiment.

Without buffering for swings in the yen, we’re overweight Japanese stocks. Their outlook seems positive given mild inflation, strong earnings growth and ongoing corporate reforms. Our overweight there will likely remain for longer than our U.S. stock overweight over a six- to 12-month tactical horizon. We’ve been underweight Japanese government bonds since July 2022. We expect yields to rise as the BOJ winds down loose policy, including yield curve control, even if likely in a measured manner.

Our bottom line

U.S. inflation has been volatile recently, but we expect it to fall further this year before resurging in 2025. We see the BOJ ending negative interest rates – but eye risks to market sentiment. We’re overweight U.S. and Japan stocks.

Market backdrop

U.S. stocks retreated from near all-time highs to end the week largely unchanged, surrendering gains after the U.S. CPI and other inflation gauges surprised to the upside. U.S. 10-year yields jumped more than 20 basis points to near 4.30% after February CPI was hotter than expected, prompting markets to price out Fed rate cuts. Japanese 10-year yields reached this year’s high near 0.8% as markets eye an end to negative rates this week. U.S. crude oil prices gained 4% on supply concerns.

The Fed policy decision is the main event this week. Although markets don’t expect the first rate cut until midyear, we think they’ll focus on how the Fed is responding to recent higher-than-expected inflation data. Markets may also assess whether Fed projections indicate a more persistent inflation outlook. Meanwhile, the BOJ could end its negative interest rate policy as soon as this week, with markets pricing a small hike. We also await the Bank of England policy decision.

Week Ahead

March 19: BOJ policy decision

March 20: Fed policy decision; UK CPI; euro area consumer confidence

March 21: BOE policy decision; global flash PMIs; Japan trade data

March 22: Japan CPI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 18th March, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.