Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, David Rogal – Portfolio Manager, Fundamental Fixed Income and Natalie Gill – Portfolio Strategist, all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Not a typical easing cycle: More central banks are starting to cut policy rates, but we think they’ll remain above pre-pandemic norms. We prefer short-term government bonds and credit.

Market backdrop: U.S. stocks slid last week in a volatile week. U.S. bond yields dropped sharply after soft jobs data spurred expectations for a bigger Fed rate cut next month.

Week ahead: We track China inflation and activity this week. China’s trade data are likely to show exports are still underpinning an otherwise weak economy.

Central banks are starting to cut policy rates after the quickest hikes in decades. Cooling inflation should allow the Federal Reserve to cut next month. Yet we see persistent inflation pressures, partly due to ongoing fiscal deficits, keeping interest rates higher on average than pre-pandemic levels. We favor short-term government bonds and credit even as markets eye more rate cuts. In Japan, we review our equity overweight given the heightened uncertainty on monetary policy.

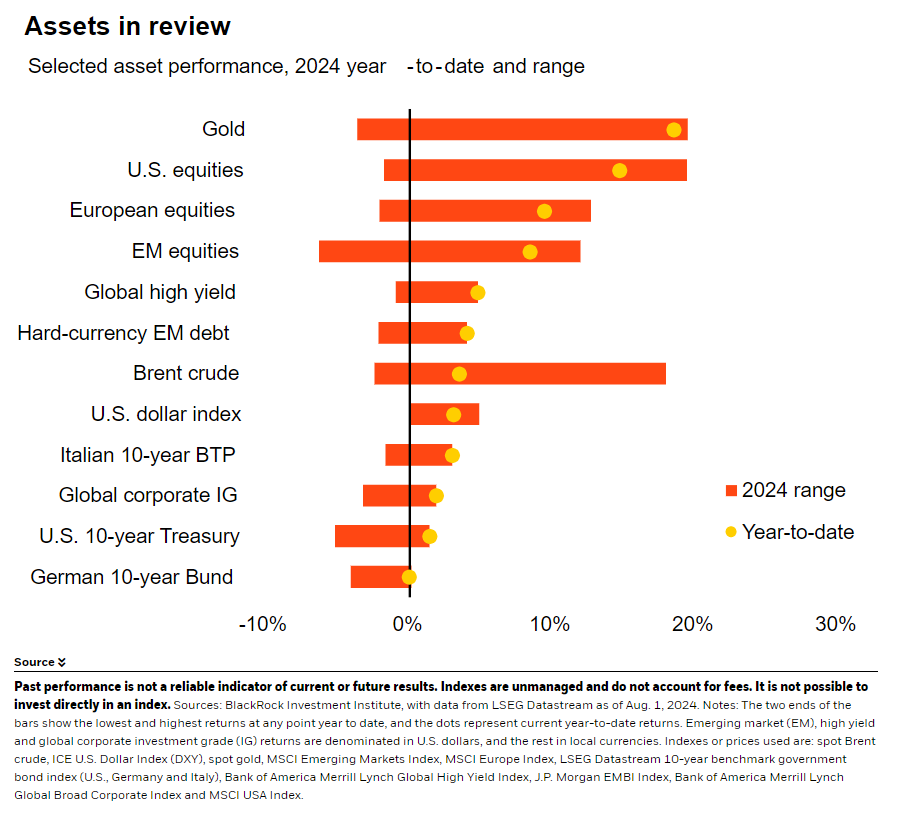

Investor appetite for bonds has grown. That comes as markets have priced in more Fed rate cuts on data showing cooling inflation and a softer U.S. jobs market. The Fed opened the door to a September cut last week, as we expected. Then the payrolls data stoked recession fears and market hopes for a large 50-basis point cut next month. We see this as another flip-flop in the market narrative with little evidence backing it: Unlike in recessions, a growing workforce is driving the rise in the higher unemployment rate, not falling employment. We stay cautious on long-term bonds, especially after the sharp yield drop over the past month. We still favor short-term paper including credit: It can offer similar income to long-term bonds with less sensitivity to interest rate swings. See the chart. That view has played out as short-term yields have dropped – and we think long-term yields can climb anew.

We think long-term yields will eventually climb in the long term as investors demand more term premium, or compensation for the risk of owning long-term bonds. The return of term premium will take time, so we stay tactically neutral long-term Treasuries as yields swing sharply on shifting policy expectations. We believe last week’s yield drop on higher rate cut hopes and growth fears are overblown. The labor market remains resilient: jobs gains are slowing but strong, employment is still rising and layoffs are not increasing. And even if near-term U.S. inflation is proving volatile, ongoing pay pressures and a shrinking workforce support services inflation longer term. That, and large U.S. fiscal deficits in the future, could keep the neutral interest rate – one that neither stokes nor restricts growth – higher than pre-pandemic.

Catalysts ahead

We see catalysts for term premium’s return, but timing is uncertain. One catalyst: the U.S. election likely shifting focus to the fiscal outlook. The Treasury’s bond issuance calendar suggests it doesn’t need to make major changes for now. We think net issuance will eventually need to climb to match the pace of government spending. Markets struggling to absorb this supply could boost term premium. The Fed altering the size of its balance sheet or the maturity of its bond holdings is another catalyst. It’s still a big buyer, purchasing 10% of 10-year and 30-year bonds in 2023 and holding about 30% of bonds with maturities longer than 10 years in circulation, based on analysis of New York Fed data by our portfolio managers. The mix of buyers also matters: While foreign buyers have retreated, U.S. households are increasingly stepping in to buy.

The BOJ policy shift also matters for global term premium. Its move to more actively manage inflation risks could boost bond yields and prompt domestic investors to favor local bonds over foreign bonds, especially in the U.S. and euro area. We see a greater risk of a BOJ policy misstep and are reviewing our overweight to Japanese stocks. A stronger yen had limited the return hit to our currency unhedged preference, with the MSCI Japan down 4% from its recent peak as of Friday. But we have lower conviction given the policy uncertainty.

Bottom line

The start of rate cuts doesn’t mean this will be the typical easing cycle, and markets can overreact to volatile data given lighter trading activity. We prefer income in short-term bonds and credit, and trim our overweight to Japanese stocks.

Market backdrop

U.S. stocks slid last week, with small cap shares and tech leading the way. Growth fears exacerbated by soft U.S. jobs data drove a broad global risk-off move. U.S. two-year Treasury yields fell to 15-month lows near 3.90% as markets priced in the potential for a 50-basis point rate cut in September and multiple cuts through 2025. Japan’s Topix stock index tumbled more than 6% last Friday – its worst day in eight years – on concerns about the BOJ policy shift and a resurgent yen.

China’s economic data is in focus this week. Chinese exports have proven resilient, helping prop up growth – and the latest trade data will give clues if that is still the case. Yet manufacturing activity has weakened, and subdued retail sales reflect cautious households struggling with the property sector’s woes. We eye the services PMI for more clues on consumer spending. Weak activity has led to low inflation and even deflation. Without meaningful policy support for growth, we don’t see that picture changing much.

Week Ahead

Aug. 5: Caixin services PMI

Aug. 6: U.S. trade data

Aug. 7: China trade data

Aug. 9: China PPI and CPI inflation

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 5th August, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.