Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Devan Nathwani – Portfolio Strategist and Carolina Martinez Arevalo – Portfolio Strategist, all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Looking through volatility: Recent extreme market volatility show the impact of sudden sentiment shifts and sharp position unwinds. We lean into risk and our high-conviction ideas.

Market backdrop: U.S. and Japanese stocks clawed back after a record three-day slide in Japan. The yen slipped back after surging to seven-month highs against the dollar.

Week ahead: The July U.S. CPI is in focus. Recent inflation and jobs data stoked expectations of sharp rate cuts. We see cuts ahead but rates settling higher for longer

We had warned risk sentiment shifts and stretched positioning could lead to market air pockets of volatility. That played out as the yen surged and Japanese stocks suffered their worst three-day stretch ever, forcing the Bank of Japan to walk back a hawkish policy shift. We stay overweight Japanese equities as a result. In the U.S., macro data shows a slowdown, not a recession, in our view. We keep our overweight to U.S. stocks and are encouraged by upbeat tech earnings.

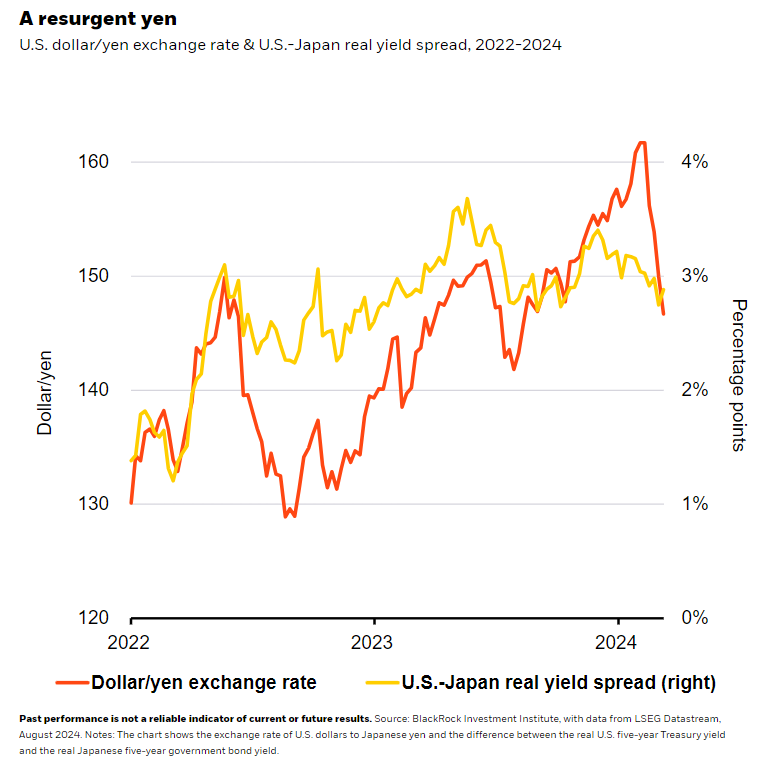

Unwinds of stretched positions, U.S. recession fears and policy uncertainty have sparked big market swings – exacerbated by thin trading activity. The BOJ’s sudden willingness to incorporate the yen as a factor in setting policy accelerated an unwind of carry trades that use the low-yielding yen to buy other assets. Speculators scrambling to close their short-yen positions drove one of the largest unwinds in yen futures on record in the past few weeks, according to CFTC data. Just how much of the carry trade has unwound is hard to quantify given the over-the-counter nature of many yen-funded positions. Yet the sharp closing of the gap between currency and rate spreads – see the chart – and rapid cutting of futures positions suggest a major unwind. Another position unwind – equity dispersion trades tied to index and single-stock volatility – magnified the stock slide.

Up until recently the BOJ had been deliberate in trying to normalize policy without jeopardizing Japan’s return of inflation. Then came its sudden rate hike in July and blurring of its policy framework, including the yen as a factor. The rise of a BOJ policy misstep prompted us to reconsider our positive view on Japan. Yet we felt the BOJ would be forced to walk back – and did. We think the BOJ will now proceed cautiously on policy, so we stay overweight Japanese stocks on a currency-unhedged basis. Further carry trade unwinding and yen strengthening is a risk. Yet we like the virtuous circle of inflation driving wage growth – and thus corporate pricing power and earnings. Corporate reforms aimed at adding shareholder value are also key.

Slowdown, not recession

While Japan bore the brunt of last week’s turbulence, U.S. recession fears sparked the latest slide after U.S. payrolls data for July showed an uptick in the unemployment rate. Yet the unemployment rate is still remarkably low by historical standards – and it’s rising because of a growing labor force tied to immigration, not because of job losses. Total U.S. payrolls have grown more than 1 million over the past six months, well above usual pre-recession levels. The latest jobless claims, ISM services data and Fed bank lending survey all paint the picture of an economy that is slowing, not approaching recession, in our view.

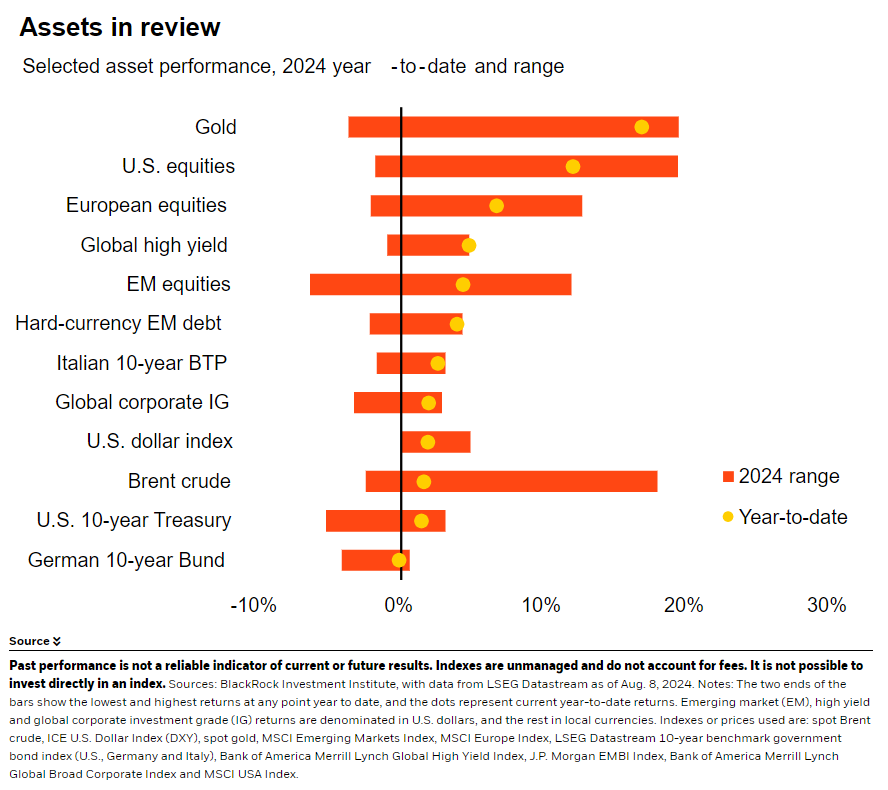

Stronger-than-expected U.S. corporate earnings, especially in tech, reaffirm our positive U.S. view. To date, Q2 earnings growth for tech versus non-tech sectors sits at 20% and 5%, respectively – up from expectations of 18% and 2% at the start of earnings season, according to LSEG Datastream data. While tech is leading the charge, non-tech sectors are poised to log their first earnings growth since late 2022, a sign strong earnings may be broadening out. Easing cost pressures and moderating inflation have benefited U.S. corporates. We stay overweight U.S. stocks and the artificial intelligence (AI) theme.

Our bottom line

We could still see air pockets of volatility in thin summer trading conditions. Rather than dialing back risk, we lean into our highest-conviction ideas. We stay overweight Japanese and U.S. stocks, and favor the AI theme in the U.S.

Note: The Global weekly commentary will resume on Tuesday, Sept. 3. But we will be responding to market volatility if it resumes, such as with our recent BlackRock Bulletin.

Market backdrop

U.S. stocks were flat last week, clawing back losses from Monday’s slide when Japan’s Topix plunged 12% for a record three-day drop. U.S. 10-year Treasury yields rose roughly 30 basis points from 14-month lows hit Monday during the worst of the tumult. Lower-than-expected U.S. weekly jobless claims helped alleviate recession fears, which we had flagged as overdone anyway. The yen eased from seven-month highs against the U.S. dollar, easing pressure on the unwind of carry trades.

July U.S. CPI is in focus this week. Inflation below expectations and soft July U.S. payrolls data have radically shifted the Fed and market narrative. Both services and shelter inflation have come down materially in recent data, and wage inflation has eased to its softest pace since 2020. Yet we are not convinced inflation will ultimately come down in line with the Fed’s 2% target.

Week Ahead

Aug. 13: UK labor market release

Aug. 14: U.S. CPI; UK CPI

Aug. 15: Philadelphia Fed business index; UK GDP; Japan GDP

Aug. 12-19: China Total Social Financing

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 12th August, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.