Jean Boivin Head of the BlackRock Investment Institute together with, Wei Li, Global Chief Investment Strategist, Alex Brazier, Deputy Head and Scott Thiel, Chief Fixed Income Strategist all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

More tightening ahead: We see central banks on a path to overtighten policy. Their balance sheet reductions up selling pressure on government bonds, so we’re underweight.

Market backdrop: We think rates will – and may already have – hit levels that make recessions foretold. That isn’t yet reflected in earnings and market pricing, in our view.

Week ahead: The Federal Reserve is set to raise rates by 0.75% for the fourth consecutive time. U.S. jobs data will be closely tracked for signs of the labor market cooling.

Markets are rallying on hopes policy tightening is nearing an end – prematurely, in our view. We think the Fed, like other developed market (DM) central banks, will only stop when the severe damage from rate hikes is clearer. Rates have already hit levels that may trigger recessions, in our view. Plus, shrinking central bank balance sheets put selling pressure on long-term government bonds and risk causing market mayhem. That keeps us underweight stocks and government bonds.

Balance sheets to shrink

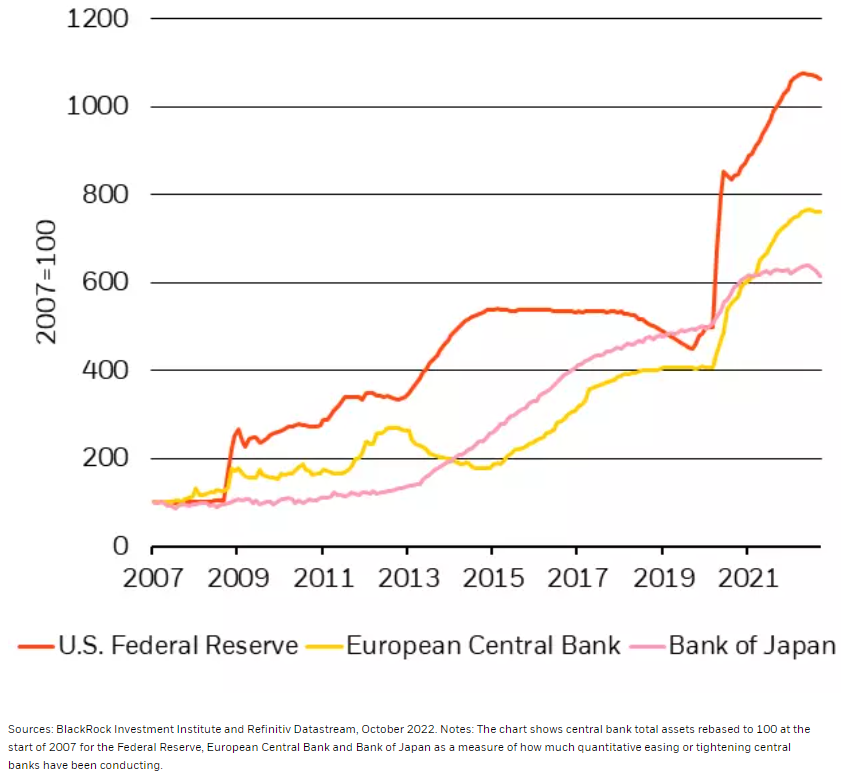

Central bank balance sheets, 2007-2022

Rate hikes have consumed the market’s attention this year. And rightly so. Central banks are taking a “whatever it takes” approach to pushing inflation back down to their targets, in our view. Just last week, the European Central Bank (ECB) raised rates another 0.75%. Markets expect the Fed to do the same this week. That’s a record pace for the ECB – one it’s signaled may slow – and the fastest hiking cycle for the Fed since the 1980s. Most major central banks aren’t fully acknowledging that hiking enough to tame inflation will cause recessions, as we see it. There’s another specter looming over markets: balance sheet reductions, or quantitative tightening (QT). Balance sheets have already started to dip this year. See the chart. Central banks selling or ceasing to buy government bonds could increase the risk of financial dislocations from yield spikes sparking risk asset selloffs.

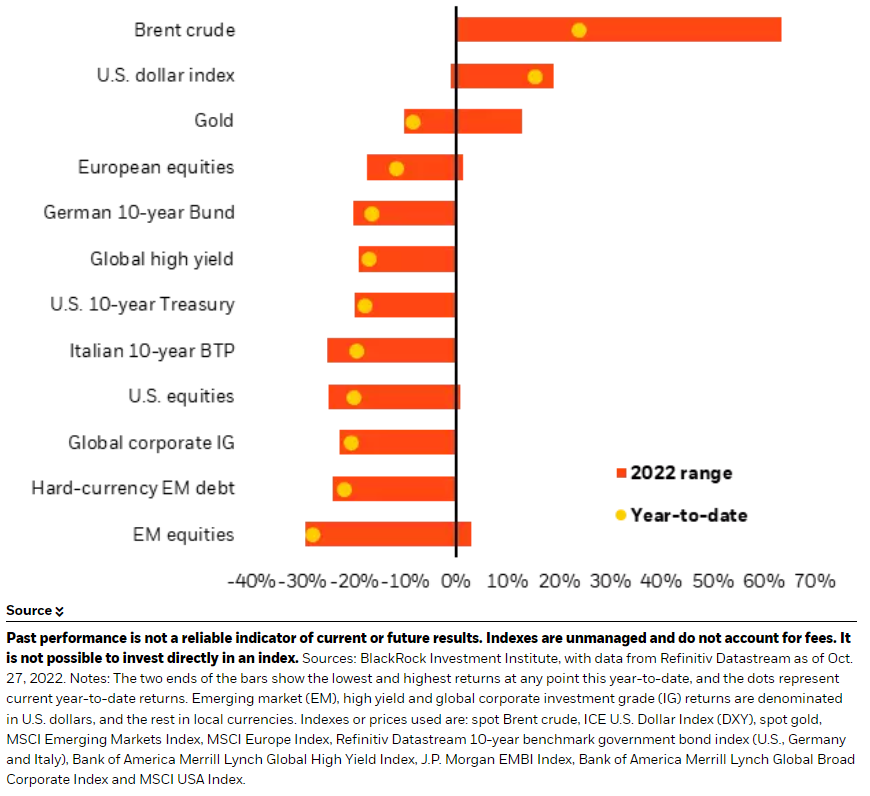

Bond yields have already jumped markedly this year. U.S., euro area and UK 10-year bond yields have each surged nearly 250 basis points since the start of the year. That’s primarily because markets are expecting higher policy rates. And investors aren’t yet demanding significantly higher compensation, or term premium, for the risk of holding long-term bonds, as we’ve said before. QT could push up term premium, boosting the structural increase we see ahead as markets price in inflation risk and rate volatility in this new regime.

Varied QT playbooks

The process, timing and effects of QT will play out differently across central banks. The Fed trims its balance sheet by letting bonds run off, or reach their maturity date without replacing them, rather than selling them. That process started in June. It’s unclear how long it will continue for, but the trimming of the $9 trillion balance sheet increases the risk of overtightening policy as the Fed keeps up aggressive rate hikes. A $2.2 trillion drop in the balance sheet over three years would hit bond markets the same as a roughly 30-basis-point hike in a normal scenario – and an 80-basis-point hike in times of crisis, Atlanta Fed research shows. The U.S. Treasury is looking at potential disruptions to trading liquidity, asking primary bond dealers if it should buy back some less-traded bonds to reduce volatility as liquidity, or the ability to trade, has deteriorated.

Kicking off its QT, the ECB said that in November it would start incentivizing banks to hand back the emergency cash they borrowed and no longer need. Bond runoffs may be in store for next year. QT could widen the differences between the yields for member countries’ bonds. That’s particularly a concern for Italy, given its current account deficit and heavy debt load. The ECB’s anti-fragmentation tool and continued reinvestment of maturing bonds during its pandemic program may stave off some widening of peripheral yield spreads. This week, the Bank of England (BoE) will become the first major central bank to sell bonds as part of QT, temporarily delayed during the turmoil of the long-term gilt selloff that prompted renewed purchases. The UK episode shows how financial dislocations can cause a delay or pause in QT programs. That may feed perceptions of financial dominance – that central banks have no choice but to keep buying bonds due to market strains.

Our bottom line

We think further, if slower, rate hikes are coming along with QT. QT may add to market strains and reasons why investors start demanding term premium, driving long-term bond yields higher, so we stay underweight DM bonds. Within an underweight to Treasuries, we prefer short-dated bonds given better returns and less duration risk. We stay underweight DM stocks whose valuations don’t reflect the recession we expect to hit corporate earnings.

Market backdrop

Developed market stocks rebounded and bond yields last week fell on hopes that major central banks will start to slow and halt rate hikes. We don’t see this as a catalyst to turn positive on risk assets. Rates will – and may already have – reached levels that constitute overtightening, making recessions foretold, in our view. The U.S. PCE data may embolden the Fed and is consistent with it pushing ahead with hikes causing major economic damage if it wants to bring inflation down to target.

All eyes are on the Fed as it is set for a fourth straight 75 basis point hike. Markets are hoping it will slow and eventually stop hiking. But we think the Fed will only stop raising rates once the economic damage from their tightening becomes clear. U.S. payrolls will be closely watched for any signs of whether slowing activity is impacting demand for labor.

Week Ahead

Oct. 31: Euro area GDP and inflation

Nov. 2: Federal Reserve policy decision

Nov. 3: Bank of England policy decision

Nov. 4: U.S. payrolls

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 31st October, 2022 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Investor Information Document (KIID), which may be obtained from MeDirect Bank (Malta) plc.