Wei Li – Global Chief Investment Strategist, together with Alex Brazier – Deputy Head, Ben Powell – Chief Investments Strategist for APAC, and Axel Christensen – Chief Investment Strategist for LatAm & Iberia all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Emerging market appeal: We are leaning into our preference for emerging market (EM) assets due to China’s restart, ending EM interest rate hiking cycles and a weaker U.S. dollar.

Market backdrop: Global stocks were flat on the week. PMI data showed economic activity holding up in the U.S. and Europe. Sticky UK inflation pointed to more rate hikes.

Week ahead: This week’s GDP data in the U.S. and euro area will help gauge the economic damage from rate rises. We see hikes hitting growth later this year.

Our new playbook calls for quickly shifting portfolios based on how much damage is priced in. We went overweight EM stocks and our long-held preference for EM debt in March on a six- to 12-month tactical horizon as they price in more rate hike damage than developed markets (DM). We took advantage of near-term events favoring EM assets: China’s economic restart, pausing EM interest rate hikes and a weaker U.S. dollar as the Federal Reserve nears the end of its rate hike campaign.

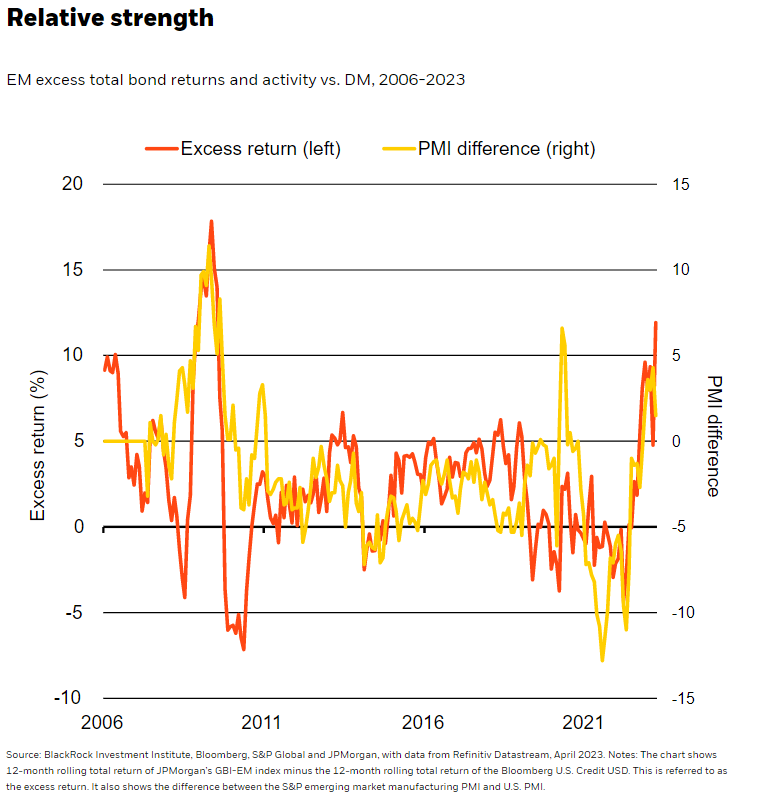

It may seem an unusual time to favor EM after major central banks’ rapid interest rate hikes. Yet we’ve seen a clear resilience in EM economic activity (yellow line in chart) even as rising rates have slowed DM activity. Total returns for EM debt have jumped above returns for DM credit since mid-2022 ( dark orange line) as a result. A key difference: EM central banks kicked off rate hikes as much as a year before DM peers. Some already stopped hiking, while DM central banks have more to do and likely won’t cut rates soon given stubborn inflation. Brazil’s central bank has held its policy rate at 13.75% since September. Central banks for India, South Korea and other nations have paused policy rates more recently. Rate cuts would help ramp up EM economic growth sooner than in developed economies. The International Monetary Fund still sees EM GDP growth about three times higher than for advanced economies this year and next, its April forecasts show.

We don’t think EM central banks will need to keep up with DM central banks’ rate hikes to avoid currency depreciation. EM currencies have, in fact, gained against the U.S. dollar as the Fed nears the end of its hiking cycle. Plus, EM debt is now more concentrated in local currencies than the dollar, JP Morgan index data show. We think that makes any future weakening in EM currencies easier to handle. This means EM central banks have paused and can begin cutting rates sooner than DM counterparts. We see DM central banks keeping rates higher for longer to fight sticky inflation, making rate cuts this year unlikely. This will all help EM economies keep outpacing developed economies this year, in our view. We turned overweight EM local-currency debt again in March, after having a relative preference for most of last year. While fund flows show investors have favored EM stocks since 2022, flows into EM local debt remain more muted and have the potential to increase.

EM stocks’ near-term appeal

Even with investors leaning into EM shares, they’ve underperformed DM stocks for over a decade. We don’t think EM shares are reflecting the likely growth outperformance of emerging economies this year. We went overweight EM stocks in February to get short-term exposure to China’s restart. The restart helped China’s Q1 GDP beat market expectations last week, in line with our view of growth around 6% for the year. It’s also helped EM economic activity outpace DM economies since the year started. We expect policy in China to stay supportive given very low inflation, and that benefits EM stocks: Chinese companies make up a large share of major EM equity indexes. The pickup in Chinese demand and tourism should especially boost Asian firms’ earnings and shares. Renewed demand for commodities is another positive helping emerging economies such as in Latin America.

Longer term, China’s powerful restart doesn’t change structural trends like aging populations and tensions with the U.S that will drag on long-term growth. We think the geopolitical risk of holding Chinese assets has risen. We see investors demanding more compensation to reflect that and risks from regulatory and government intervention.

Our bottom line

We like EM stocks and bonds over DM in the short run. We also prefer higher-rated countries within EM debt such as Mexico, similar to our overall quality preference – especially within DM equities and credit. Higher-rated countries have falling inflation, more balanced external accounts, adequate currency reserves and lower debt-to-GDP levels. Yet EM assets wouldn’t be immune to a risk asset selloff and U.S. dollar surge from more Fed hikes. Our relative views flip on a horizon of five years and over. We see geopolitical risks weighing on EM risk-adjusted returns, so we prefer DM equities in the long run. We also think DM economies will benefit more from the transition to a lower-carbon world than EM on that horizon.

Market backdrop

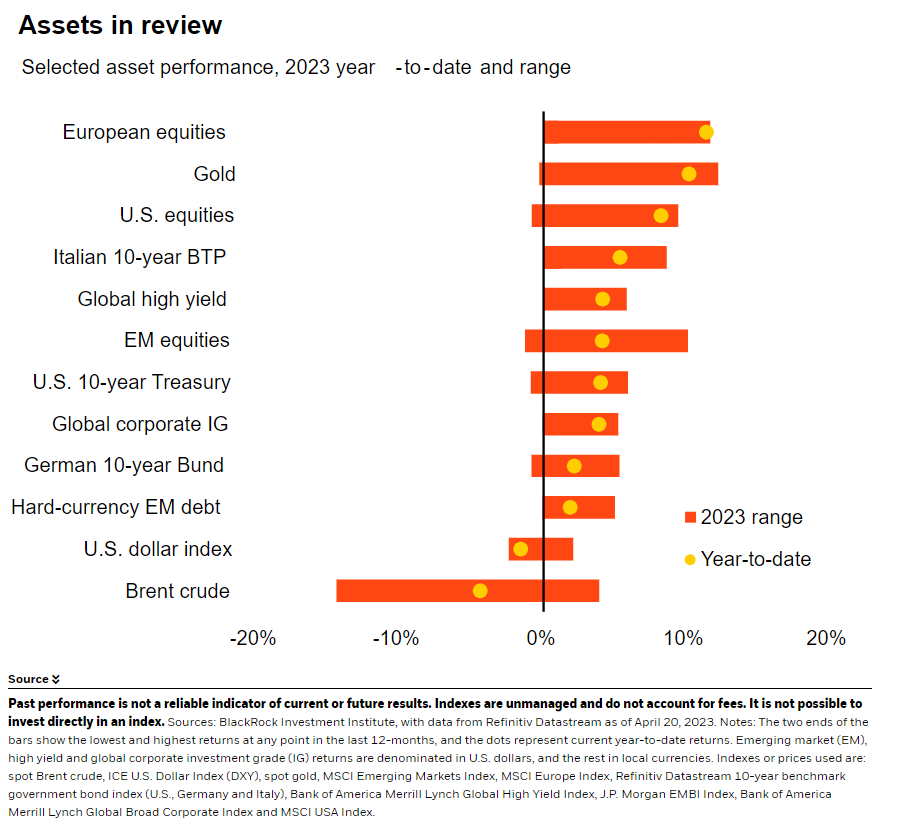

U.S. stocks paused as European stocks hit a 14-month high last week. U.S Treasury yields largely steadied after a recent rise on expectations for the Fed to hike rates in May. The March UK inflation data showed how sticky inflation is proving across major economies. Sticky inflation and the April PMI data showing economic activity holding up in the U.S and Europe suggest major central banks have more work to do to fight inflation. We don’t see them coming to the rescue with rate cuts this year.

GDP data in the U.S. and euro area this week will help gauge the economic damage from rate rises. We see hikes hitting growth later this year and no rate cuts in 2023 from major central banks. We expect the Fed to stop hikes when the damage is clear but think the European Central Bank will keep going to get inflation to target regardless of the damage that entails.

Week Ahead

April 25:U.S. consumer confidence

April 27: U.S. Q1 GDP

April 28: U.S. PCE and Employee Cost Index; euro area GDP; Bank of Japan policy decision

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 23rd April, 2023 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.