Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute together with Catherine Kress – Head of Geopolitical Research, Alex Brazier – Deputy Head and Alex Christensen – Chief Investment Strategist of Latin America all forming part of the BlackRock Investment Institute, share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

A new world order: Geopolitical fragmentation is accelerating, as seen with recent events in Asia and the Middle East. We see it keeping inflation pressures elevated longer term.

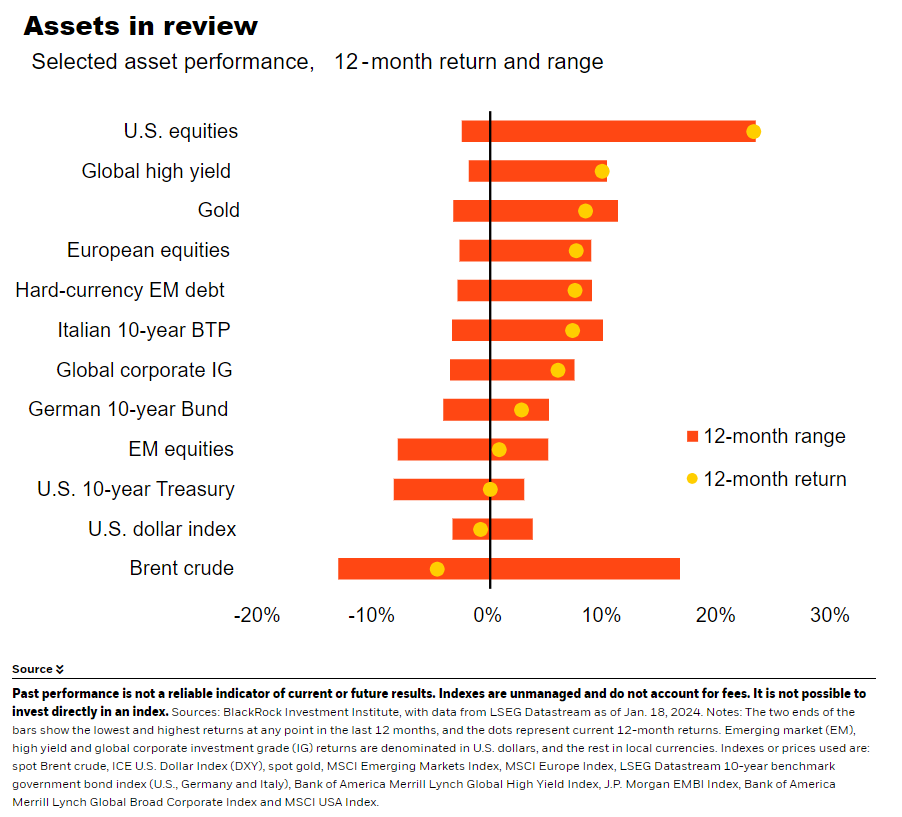

Market backdrop: U.S. stocks climbed to record highs last week. The 10-year U.S. Treasury yield rose as markets priced in fewer rate cuts – but still more than we expect.

Week ahead: We think the European Central Bank will hold rates steady at its policy meeting this week, and the Bank of Japan faces pressure to tighten its ultra-loose policy.

Geopolitical fragmentation, one of five mega forces or structural shifts we track, is playing out in recent events in Asia and the Middle East. Yemen’s Houthi militants attacking Red Sea shipping highlights how hot spots can hit supply chains and up production costs. Fragmentation is a key reason we see persistent inflation pressures – keeping policy rates above pre-Covid levels. Countries like Mexico and Vietnam, and strategic sectors like tech could benefit from globalization rewiring.

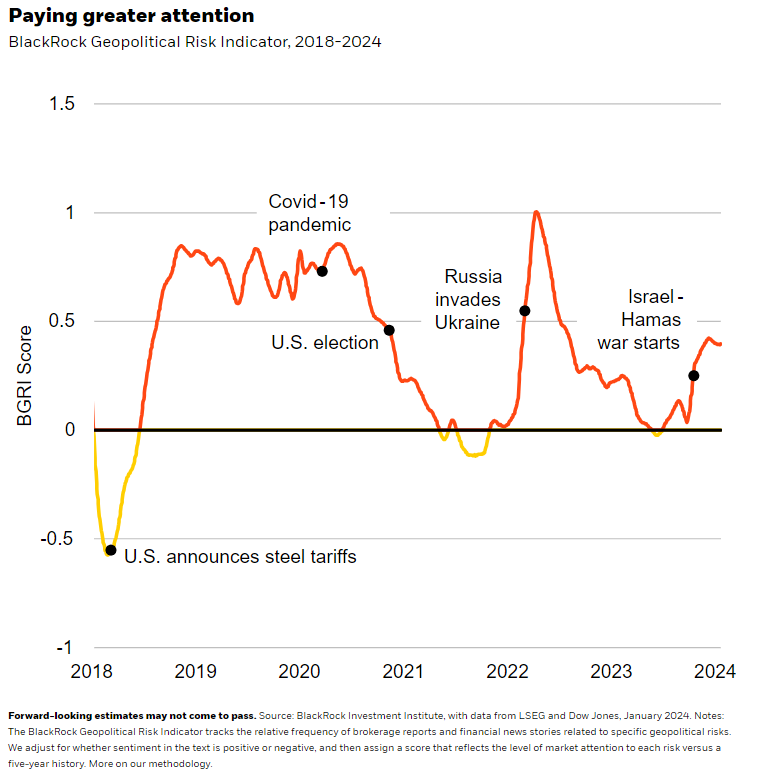

Geopolitics has become a persistent and structural market risk over the last half-decade, in our view. The world has faced cascading crises – from the U.S. trade wars to the Covid-19 pandemic, Russia’s invasion of Ukraine and now war in the Middle East. These developments have accelerated global fragmentation and the emergence of competing geopolitical and economic blocs. And the openness of countries to trade with each other has stalled, based on world trade as a share of global GDP. This is a marked departure from the globalization and geopolitical moderation of the post-Cold War period. We see the rewiring of globalization along geopolitical lines ramping up as countries and companies favor national security and resilience over pure cost efficiency. So it’s no surprise markets are paying more attention to geopolitics, as measured by our Geopolitical Risk Indicator (see chart).

Geopolitical fragmentation is one of the reasons we see persistent inflation pressures – and policy rates staying above pre-pandemic levels. Supply chains are becoming longer and more complex as “connector” countries like Mexico and Vietnam increasingly act as intermediate trading partners between different geopolitical blocs. Such countries may stand to benefit from competition between blocs, yet significant investment will be needed in areas like critical infrastructure for benefits to fully materialize. Companies that prove resilient to shifting supply chains may have a competitive edge – and some will also benefit from robust industrial policies like the U.S. Inflation Reduction Act and CHIPS and Science Act.

Greater geopolitical volatility

Fragmentation’s economic and market impact will depend, in part, on if changes to the global order are managed or disorderly. Greater geopolitical volatility – and the rising number of violent conflicts worldwide – increase the risk of a more disorderly and less predictable path. Yet as broad stocks and other assets move on quickly from geopolitical events, we worry they may not be appreciating that we have entered a new geopolitical regime. The old playbook no longer applies, in our view.

On the risks we’re monitoring, we reaffirmed our highest-level Gulf tensions rating in December given the ongoing Israel-Hamas war. The risk of escalation is high, we believe, with attacks by Iranian-backed groups on the rise. The disruption of Red Sea shipping aiming to pass through the Suez Canal shows how the conflict can expand to hamper supply chains and drive up production costs, in this case via rising shipping costs. We keep our U.S.-China strategic competition risk rating at a high level. The November meeting between the U.S. and Chinese presidents has helped set a more positive tone for relations and expanded communications in the near term. But Taiwan remains a significant flashpoint, as the recent election shows. We think intense, structural competition between the U.S. and China is the new normal, especially in defense and technology.

Our bottom line

We expect deeper fragmentation, heightened competition and less cooperation between major nations in 2024. We see the rewiring of globalization benefiting countries like Mexico and Vietnam. It will also likely spur a surge of investment in advanced tech, clean energy, defense and other sectors seen as critical to a country’s economic and geopolitical goals.

Market backdrop

The S&P 500 closed at its highest ever last week, and gains in tech shares pushed the Nasdaq 100 to an all-time high. The U.S. 10-year yield climbed above 4.10% as markets trimmed expectations for Federal Reserve interest rate cuts this year but still eye about six quarter-point cuts. Better-than-expected retail sales and Fed comments warning against rapid rate cuts spurred the repricing. We still see market pricing of rate cuts as overdone given the inflation rollercoaster we expect, but the quick shift in expectations underscores the importance of managing macro risk as market narratives can suddenly flip flop.

Policy rate decisions by central banks are in focus this week as both the ECB and BOJ meet. We expect the ECB to hold rates steady ahead while communicating future cuts. We’re also following the BOJ as it faces pressure to tighten its ultra-loose policy. In the U.S, a slew of activity data is due for release, including PCE inflation data. We expect inflation to fall to 2% by year end as goods prices slide, but we see the risk of resurgent inflation coming into view later this year.

Week Ahead

Jan. 23: Bank of Japan (BOJ) policy decision

Jan. 24: Global flash PMIs

Jan. 25: U.S. GDP; European Central Bank (ECB) policy decision

Jan. 26: U.S. PCE

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 22nd January, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.