Jean Boivin – Head of BlackRock Investment Institute together with Wei Li – Global Chief Investment Strategist, Glenn Purves – Global Head of Macro and Christian Olinger – Portfolio Strategist, all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

Binding economic rules : U.S. policy shifts are adding to the global transformation already underway. We track rules that will shape policy and focus on themes – like AI – driving returns.

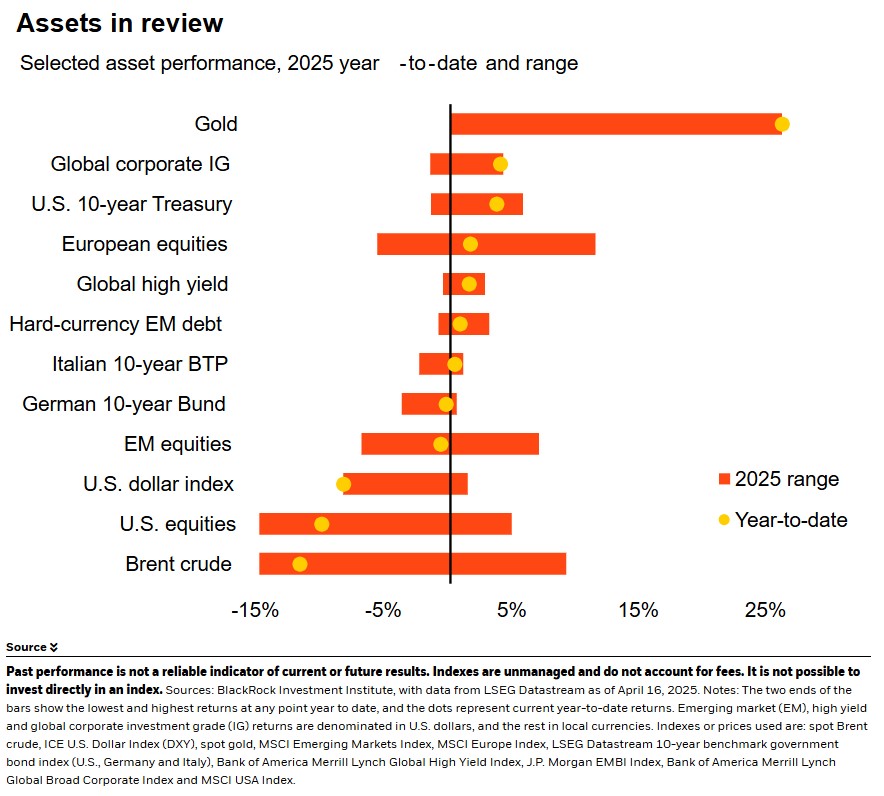

Market backdrop : U.S. stocks steadied last week but are still down 6% since the April 2 tariff announcement. U.S. 10-year yields are up since then to near 4.35%.

Week ahead : Global flash PMIs will be the main focus this week to see how U.S. tariffs and policy uncertainty are impacting incoming orders and the outlook for activity.

We have argued for a few years that mega forces, like geopolitical fragmentation, are transforming the world. U.S. trade policy is adding to this transformation. This isn’t a business cycle, but a long-term structural shift. It raises big questions about the trajectory for global markets, making long-term expectations more sensitive to short-term news. We focus on themes that can drive returns over broad asset classes. We see the AI mega force driving returns over time, mostly in the U.S.

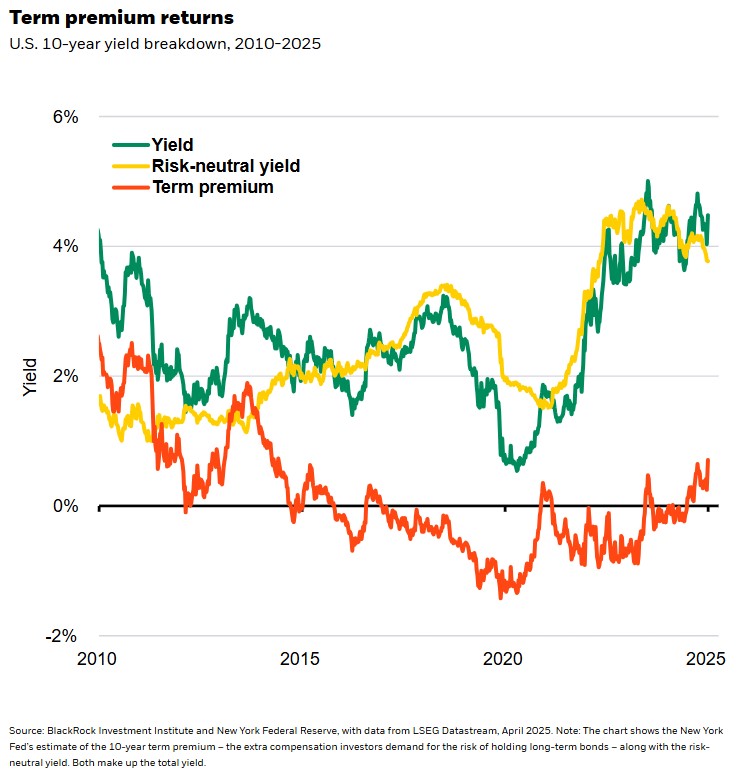

How will the role of U.S. Treasuries in portfolios evolve? It’s one of the big questions raised by the recent collision of two mega forces: geopolitical fragmentation and the future of finance. We argued in 2021 that higher inflation and interest rates at a time of elevated debt create a “fragile equilibrium” for U.S. bonds, one vulnerable to shifts in investor confidence. We have long expected structurally higher interest rates. The recent unusual surge in Treasury yields as U.S. stocks and the dollar slid suggests a desire for more compensation for risk and brought that fragile equilibrium into sharp focus. See the chart. Predicting the end state of a transformation is near impossible, compounded now by unpredictable trade talks. Yet the policy-setting process will bump up against economic rules that put bounds on the realms of what’s possible. We track those rules, not each policy twist.

The U.S. runs large fiscal deficits and high debt, about 30% of which is held by foreign investors, Fed data show. An economic rule in play here? The current account deficit cannot be reduced without a corresponding fall in foreign financing. By pushing to reduce the trade deficit quickly, the U.S. will find it harder to finance its debt, especially if unpredictable tariff negotiations dent the confidence of foreign investors. That points to higher bond yields and debt servicing costs, upending budgetary arithmetic. Another rule? Global supply chains can evolve over time but cannot be rewired at speed without major disruption. Tariffs not only raise costs but can cut access to key inputs and potentially halt production. That risks a growth slowdown or recession with high inflation, just like in the pandemic. That limits any central bank response. In seeking to slash trade deficits fast, the U.S. will bump up against these economic rules. That seems to have already happened with the recent rapid Treasury selloff and tariff exemptions for electronics to avoid the most obvious supply chain disruptions.

Economic rules in play

We see U.S. policy shifts adding to the structural transformation already underway. That transformation could have any number of outcomes in coming years. We can no longer extrapolate from past trends or rely on long-term assumptions to anchor portfolios. The distinction between tactical and strategic asset allocation is blurred. Instead, we need to constantly reassess the long-term trajectory and be dynamic with asset allocation as we learn more about the future state of the global system. Uncertainty about that future landscape can also incentivize non-U.S. investors to keep more money in local markets.

The binding effect of these economic rules on trade negotiations mean it will take time to uproot the current system. In the near term, today’s financial order remains the starting point. We focus on themes powering the global transformation. We still see the AI mega force driving returns, especially in the U.S. We find selective opportunities in Europe, for example in banks and defense. We prefer European credit and government bonds to the U.S. How the bloc responds to shifting global dynamics and tackles its structural challenges will be key.

Our bottom line

Many different outcomes are feasible, so we navigate near-term uncertainty by tracking economic rules that will shape trade policy. We like U.S. stocks as a route to invest in AI and stay selective in Europe. We underweight U.S. Treasuries.

Market backdrop

U.S. stocks steadied after the historically big volatility since the April 2 announcement on U.S. tariffs. The S&P 500 was flat for the week and still down about 6% since then. Nvidia came under pressure after the U.S. announced export controls on one of the main chips it sells to China. U.S. Treasury yields fell on the week but are still up 14 basis points to 4.34% since April 2, highlighting their reduced ballast role in portfolios. The U.S. dollar held near a three-year low against major currencies.

Global flash PMIs for both manufacturing and services activity will be in focus this week as investors look for any signs of the U.S. tariffs, policy uncertainty and risk asset selloff having an impact. The University of Michigan’s consumer sentiment survey will also be closely watched, especially given the surge in expected inflation among households as tariffs kick in. So far, higher household inflation expectations have not fed into market pricing of future inflation.

Week Ahead

April 22 : Euro area consumer confidence

April 23 : Global flash PMIs

April 25 : UK retail sales; University of Michigan consumer sentiment

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 21st April, 2025 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document is intended for retail clients however, it may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.