Wei Li – Global Chief Investment Strategist of BlackRock Investment Institute together with Natalie Gill – Portfolio Strategis , Beata Harasim – Senior Investment Strategist and Yuichi Chigurchi – Head of Multi-Asset Strategist and Chief Investment Strategist in Japan all forming part of the BlackRock Investment Institute share their insights on global economy, markets and geopolitics. Their views are theirs alone and are not intended to be construed as investment advice.

Key Points

In support of risk-taking: We see falling inflation, nearing interest rate cuts and solid corporate earnings supporting cheery risk sentiment. We tweak our tactical views and stay pro-risk.

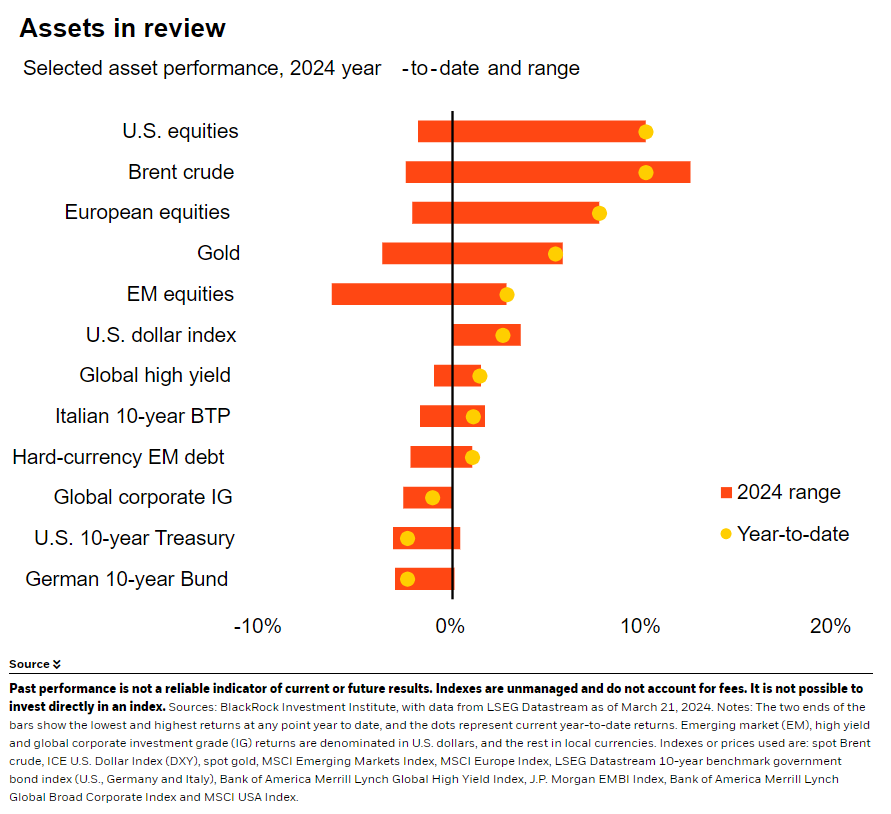

Market backdrop: U.S. stocks hit record highs last week and 10-year yields fell as the Fed stuck with planned rate cuts. Japanese stocks gained on a cautious BOJ policy pivot.

Week ahead: U.S. PCE takes center stage this week. We see goods deflation pulling down overall U.S. inflation for now before inflation resurges in 2025.

Central bank activity last week gave markets the thumbs up to stay upbeat. That keeps us pro-risk in our six- to 12-month tactical views as Q2 starts. We see stock markets looking through recent sticky U.S. inflation and dwindling expectations of Fed rate cuts. Why? Inflation is volatile but falling, Fed rate cuts are on the way and corporate earnings are strong. We stay overweight U.S. stocks but prepare to pivot if resurgent inflation spoils sentiment. We up our overweight on Japanese stocks.

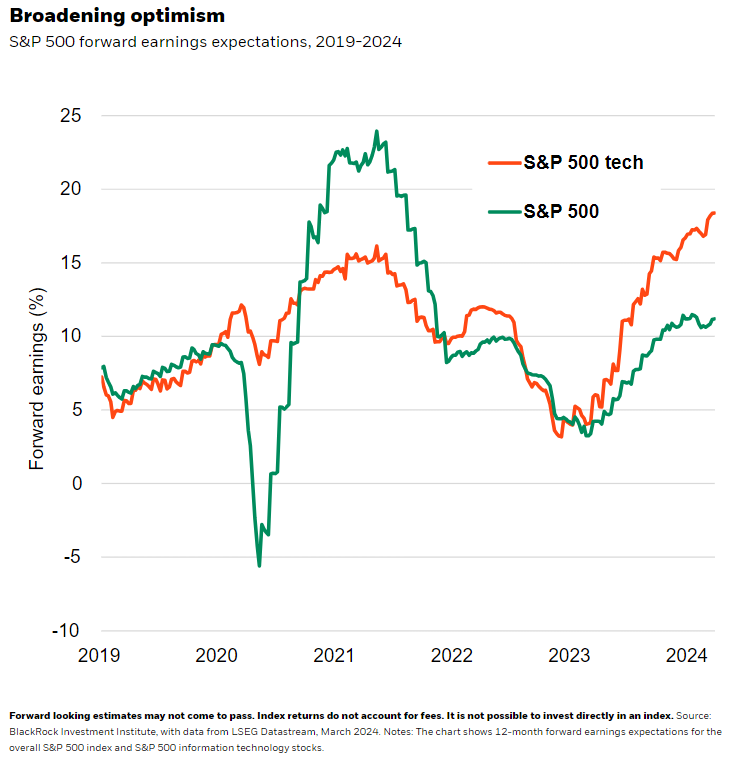

As Q2 kicks off, we still see a more supportive near-term backdrop for risk-taking. U.S. inflation has eased from its pandemic highs and growth has held up. And expectations for S&P 500 earnings growth for 2024 have been revised up to about 11%, LSEG data show. Earnings expectations are even higher for tech companies that markets see leveraging artificial intelligence (AI). See the orange line in the chart. Earnings expectations for the broader market are also on the mend (green line), with sectors except commodities and healthcare seeing earnings recover. Plus, the Federal Reserve reaffirmed its intention to make three quarter-point rate cuts this year, while lifting its growth and inflation forecasts. After the recent Fed signals, we believe the bar is high for market pricing of immaculate disinflation – inflation falling near the Fed’s 2% target while growth holds up – to be challenged.

Against that backdrop, we remain tactically overweight U.S. stocks. We think upbeat risk appetite can broaden out beyond tech as more sectors adopt AI, and as market confidence is buoyed by recent Fed messaging and broadly falling inflation. We still prefer the AI theme even as valuations soar for some tech names. Stock valuations are supported by improving earnings, with the tech sector expected to account for half of this year’s S&P 500 earnings, Bloomberg data show. That has led to a fall in price-to-earnings ratios – share price divided by earnings per share – for some companies, unlike in the dot-com bubble when they soared. To compare the periods, BlackRock’s systematic equities team analyzed 400 metrics related to valuations and other features and found that the number flashing red now is 50% lower than when the dot-com bubble burst in 2000.

Potential disruptions to our view

What would change our risk-on stance? First, risk appetite being challenged as markets shift focus from cooling inflation to inflation on a rollercoaster back up in 2025. We think it will settle closer to 3% as high wage growth keeps services inflation sticky. Persistent inflation pressures from mega forces, or big structural shifts we see driving returns, also call for a higher neutral rate – the interest rate that neither stokes nor limits economic activity – than in the past. We think the Fed’s nudged-up long-run policy forecasts are starting to reflect our view of rates staying higher for longer than pre-pandemic. Markets are not eyeing that outlook for now. Second, stocks could grow more sensitive to macro news as profit margin pressures mount.

As Q2 kicks off, Japanese equities become our highest-conviction tactical view as solid corporate earnings and shareholder-friendly reforms keep playing out. We add to our overweight because we think the Bank of Japan policy stance is supportive of local markets. The BOJ made clear that ending negative rates is about normalizing policy, not anxiety over inflation, and it pledged to limit spikes in long-term yields. We think the BOJ will act cautiously and not sabotage the return of mild inflation. We also up euro area inflation-liked bonds to neutral as market expectations for persistent inflation have eased.

Our bottom line

We see a supportive risk-taking environment for now, as inflation keeps falling and after the Fed reinforced upbeat sentiment. We stay overweight U.S. stocks and the AI theme. We go further overweight Japanese stocks.

Market backdrop

U.S. stocks climbed to all-time highs last week and U.S. 10-year Treasury yields slipped after the Fed stuck to its plans to cut policy rates three times this year even after lifting both its growth and inflation forecasts for this year. We think markets are underappreciating another change: the Fed nudging up its long-run policy rate. Japan’s Nikkei stock index hit all-time highs after the BOJ ended negative rates and lifted its yield cap. Yields on Japanese 10-year government bonds dipped slightly.

This week, we focus on U.S. PCE data, the Fed’s preferred measure of inflation. We think U.S. inflation can fall further toward 2% this year due to falling goods prices. Yet we see inflation on a rollercoaster back up in 2025, with inflation eventually settling closer to 3%. The Fed appears to be slowly adjusting to this view given its higher projections for policy rates two years out

Week Ahead

March 26: U.S. consumer confidence and durable goods; UK GDP; Japan services PPI

March 29: U.S. PCE

March 31: China manufacturing PMI

BlackRock’s Key risks & Disclaimers:

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of 25th March, 2024 and may change. The information and opinions are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain ’forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Investment involves risk including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

Issued by BlackRock Investment Management (UK) Limited, authorized and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL.

MeDirect Disclaimers:

This information has been accurately reproduced, as received from BlackRock Investment Management (UK) Limited. No information has been omitted which would render the reproduced information inaccurate or misleading. This information is being distributed by MeDirect Bank (Malta) plc to its customers. The information contained in this document is for general information purposes only and is not intended to provide legal or other professional advice nor does it commit MeDirect Bank (Malta) plc to any obligation whatsoever. The information available in this document is not intended to be a suggestion, recommendation or solicitation to buy, hold or sell, any securities and is not guaranteed as to accuracy or completeness.

The financial instruments discussed in the document may not be suitable for all investors and investors must make their own informed decisions and seek their own advice regarding the appropriateness of investing in financial instruments or implementing strategies discussed herein.

If you invest in this product you may lose some or all of the money you invest. The value of your investment may go down as well as up. A commission or sales fee may be charged at the time of the initial purchase for an investment. Any income you get from this investment may go down as well as up. This product may be affected by changes in currency exchange rate movements thereby affecting your investment return therefrom. The performance figures quoted refer to the past and past performance is not a guarantee of future performance or a reliable guide to future performance. Any decision to invest in a mutual fund should always be based upon the details contained in the Prospectus and Key Information Document (KID), which may be obtained from MeDirect Bank (Malta) plc.